By Jackson Wood, Director, Industry Strategy, Global Trade Intelligence, Descartes Systems Group

International trade sanctions and export controls grew in complexity in 2023.

This trend was driven primarily by geopolitical volatility and an ongoing effort by regulators to place greater due diligence responsibility onto private enterprises.

But the potential silver lining were new developments in compliance technology that helped organizations adapt their risk management processes to be more efficient and ultimately better able to manage regulatory volatility.

It’s safe to say it was a transformative year for any organization relying on imported goods or exporting goods to international entities. Now at the start of 2024 — it’s easy to see how many of the trade sanctions trends that defined the past year will continue to evolve and affect business regardless of industry.

After all, the compliance landscape never stands still for long, and it’s reasonable to believe that the trajectory of 2023 will continue in the new year. So, what does this mean for businesses in 2024? And what trade sanctions compliance trends should companies be aware of going forward?

Key Takeaways

- Geopolitical events: Continuing conflicts and political tension engender new risks and how governments turn to trade sanctions in response.

- UFLPA compliance: There is a determined effort to remove forced labor from supply chains.

- Putting the onus on companies: The burden of proof is increasingly on businesses to comply with trade sanctions, which can be seen in UFLPA and evolving semiconductor export controls.

- Growing ESG Obligations: Compliance requirements are extending beyond imports and exports.

- Advancing technological solution: Advances in data engineering, network mapping, along with artificial intelligence (AI) and machine learning (ML) are transforming how organizations can make their risk management processes more efficient.

Keep reading to see what trends our trade sanctions compliance experts believe will impact organizations in the coming months and beyond.

1. Growing Geopolitical Risks

| Current State of Play | Geopolitical tensions continue to rise. |

| Where We are Headed | Trade sanctions and export controls will increase in number and complexity. |

| What to do About it | Strengthen regulatory risk management processes and tools. |

Geopolitical events have created a shifting compliance and risk landscape. Russian sanctions remain in effect with new curbs being announced on an ongoing basis. The conflict between Israel and Hamas has further complicated trade sanctions compliance work in the Middle East. The U.S. and other like-minded countries have stepped up their efforts to rid supply chains of forced labor, in particular Uyghur forced labor originating from the Chinese province of Xinjiang.

Organizations in nearly every industry need to be aware of how these events are affecting trade sanctions and compliance requirements. For instance, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) recently imposed sanctions on Hamas and Iran-linked entities, detailing specific individuals and organizations that must be included in denied party screening processes. Additionally, OFAC has identified Hamas investment portfolios believed to be used to facilitate funds from abroad to Hamas.

It’s possible that 2024 will see resolutions to some of these events to a greater or lesser extent. However, even as these specific matters are resolved, sanctions may remain in effect, and any future conflicts will likely have similar governmental responses. Inadvertently transacting with any third parties subject to sanctions under any circumstance can result in significant fines, penalties, and reputation damage.

Supply chain management and visibility are therefore necessary not only for compliance reasons. Enterprises need to adopt the right tools and develop strict processes for due diligence throughout their supply chain to identify and avoid any current or future sanctioned parties.

2. UFLPA Compliance and Forced Labor Laws

| Current State of Play | Governments are more determined to remove forced labor from supply chains. |

| Where We are Headed | Tighter enforcement by the U.S. and other countries via trade sanctions. |

| What to do About it | Understand direct and indirect supply chain relationships and screen all trade chain partners regularly. |

Complying with the Uyghur Forced Labor Prevention Act (UFLPA) and related forced labor laws was challenging in 2023 because organizations needed to make sure that both direct and indirect suppliers were in compliance. Expect more of the same in 2024.

In addition, U.S. Customs and Border Protection (CBP) operates based on a presumption of guilt for any shipments originating from the Xinjiang region. The burden of proof falls on the importing companies, and goods which cannot be proven to be compliant risk being seized.

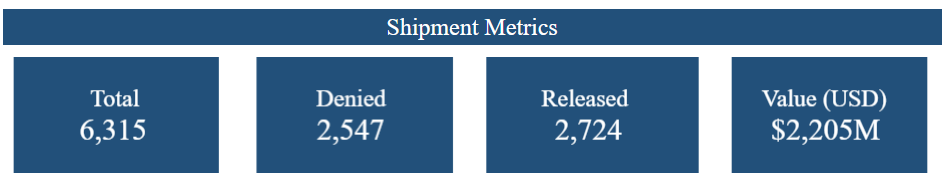

The UFLPA expands on the Tariff Act of 1930 and establishes a presumption that any goods, wares, or materials produced in Xinjiang Uyghur Autonomous Region of the People’s Republic of China involve forced labor. Since CBP started enforcement in June 2022, over 2,500 shipments worth $514 million have been denied entry into the U.S., representing 40% of all shipments and 23% of the total in terms of value. See also CBP’s UFLPA dashboard to view how forced labor trade sanctions are being enforced.

Figure 1: CBP UFLPA Enforcement Statistics between June 2022 and January 10, 2024. Source: U.S. Customs and Border Protection (CBP)

Xinjiang is a significant producer of garments, which is a result of major cotton production in the region. Toys, footwear, wind, and solar-powered items are also produced in the region, a proportion of which are presumed to involve forced labor.

Businesses across industries need to be equipped with the right tools to provide transparency to supply chain relationships, and to screen all parties in a shipment transaction. Above all, prepare for rising enforcement action. We saw significant enforcement actions in 2023, and we don’t expect them to slow down in 2024.

3. Sanction Ownership Requirements

| Current State of Play | Instructional guidance from government giving way to directional guidance. |

| Where We are Headed | Businesses are responsible for research due diligence. |

| What to do About it | Invest in the right tools to strengthen your organization’s due diligence activities. |

An ongoing trend that will continue for the foreseeable future is the increasing need for organizations to undertake accurate and strict due diligence for all third parties they engage, including a focus on sanctioned ownership regulations. The OFAC 50 Percent Rule stipulates that any entity owned 50% or more by sanctioned parties is also sanctioned, introducing added complexity to trade sanctions compliance.

However, the government does not provide comprehensive information about sanctioned party ownership, placing that responsibility on organizations. This is indicative of a more significant trend of regulatory agencies moving towards directional guidance rather than providing explicit instruction, like they did in the past. These are defined in more detail, as follows:

- Instructional guidance is how compliance requirements were often described and enforced in the past, whereby the government provided step-by-step instructions about what companies need to do to remain compliant, including what denied party screening lists to use.

- Directional guidance is becoming the new norm. This method calls for setting out more broad principles that need to be met by organizations. This approach is less about specific steps and more about achieving the end goal of complying with trade sanctions.

As a result, the responsibility for identifying companies subject to sanctioned ownership regulations is placed on each business. While the pivot to directional guidance affects trade sanctions compliance overall, it becomes exceedingly difficult when it comes to sanction ownership compliance.

For example, in response to the Israel-Hamas conflict, the United States and United Kingdom took coordinated action to sanction Hamas leaders and connected financiers. Any organization owned by these sanctioned parties by 50% or more must be identified to reduce the risk of non-compliance.

Other regulations that fit in the “directional guidance” category include the UFLPA and the military end-use export control law.

4. ESG – Broadening Compliance Obligations Across Industries

| Current State of Play | Compliance requirements are extending beyond international trade. |

| Where We are Headed | More explicit regulatory requirements for ESG and other sustainability activities. |

| What to do About it | Start creating and implementing an ESG strategy. |

Trade sanctions and compliance will remain a core concern for many organizations in the new year, but the growing need to meet compliance requirements extend beyond imports and exports. Businesses across all industries must also prioritize compliance along ESG (Environmental, Social, and Governance) lines, which includes a focus on compliance.

Many investors expect forward-thinking companies to have high ESG ratings and ongoing efforts to improve them. Statista discovered that investors today are increasingly prioritizing ESG-focused firms in their investment portfolios.

Maintaining compliance is a central pillar of ESG, and failing to meet compliance requirements can result in a decreased score, reputation, and fewer investments. Developing a robust ESG strategy is more critical than ever before. Read also this article on “Tying Third-Party Risk Management into an ESG Strategy”.

It’s, therefore, vital for organizations to have the right processes and systems in place to manage everything from trade compliance to ESG consideration, which includes proof of due diligence.

GDPR was another strong example of far-reaching compliance obligations when it came into effect in 2018, affecting organizations doing business in the European Union. However, GDPR was only the beginning, as new regulations emerge or evolve with a broader reach than specific industries or geography.

Now, far-reaching regulatory requirements necessitates that organizations create compliance teams equipped with the right skill set, systems, and processes to manage changing obligations, know how to prioritize changes and delegate tasks to the right people to implement corrective actions.

5. Continued Investment in Technology to Extend and Strengthen Compliance Operations

| Current State of Play | Businesses see competitive and productivity gains with a new breed of technology solutions. |

| Where We are Headed | Advances in technological capabilities, including the integration of artificial intelligence into compliance solutions, will grow over time. |

| What to do About it | Adopt the right tools to stay ahead of risks and minimize repetitive tasks, allowing compliance professionals to focus on higher-value activities like compliance strategies. |

Rapid advancement in Artificial Intelligence (AI) and Machine Learning (ML) solutions dominated headlines over the past year. However, compliance professionals are viewing this progress with caution. There are still many questions regarding the accuracy and reliability of these new tools.

A 2018 study came to the optimistic conclusion that AI and ML showed strong potential in the fields of compliance and risk management but noted limitations of available technologies, such as data management as well as the necessary workforce skillsets. Have we overcome these hurdles, or does more work need to be done? While the jury is still out on these questions, there are proven, mature capabilities that exist today that can help you streamline and automate key elements of your compliance practice:

Accurate, Rapid, High-volume Screening

Modern compliance software allows for efficient and accurate screening against sanctioned and denied party lists, replacing time-intensive manual processes. This use case involves monitoring current regulatory obligations and frequently identifying any changes in these obligations. The right software will notify compliance teams about changes to denied and restricted parties lists while also creating prioritized workflows. Supply chain management and visibility can reach entirely new levels of efficiency and accuracy with next-gen compliance platforms.

Better Change Notification Management

Enterprises often adopt tools that identify challenges in compliance obligations and create notifications, but that’s where it ends. This results in a flood of email notifications about compliance changes that are still daunting to sort through and assign to the appropriate teams. Leading-edge tools improve on this concept by understanding priority levels and how changes need to be delegated, saving compliance teams from sorting through tedious alerts and focusing instead on the important work of actioning, clearing or escalating suspect trade transactions.

Automation and Enablement Tools Will Become a Necessity

We expect 2024 to see even more investments into compliance and risk management technology. Risk and compliance are major focus areas for organizations across most industries, so there’s plenty of motivation to develop accurate and streamlined systems to manage trade sanctions obligations better. Bringing the right tools into these workflows minimizes tedious tasks and allows compliance teams to focus their time and energy on identifying potential violations and taking corrective action.

An Effective Trade Sanctions Compliance Tool is Crucial for 2024

Each of the above trends we saw take shape or scale up throughout 2023, and they’ll continue on into the new year. It’s essential that your organization maintains a keen eye on these areas of focus, and invests in the tools and skills necessary to protect the business from regulatory, reputational, and resiliency risks in the months and years ahead.

With trade sanctions compliance requirements only getting more complex, businesses should be actively thinking about adopting an agile approach to managing international business activities, not only to ease the burden but also to accelerate growth efforts.

Descartes is an industry leader in equipping organizations with proven compliance solutions. We strive to leverage insights gleaned from supporting over 3,000 customers and 50,000 users to help keep you compliant. Ready to learn how we can help? Reach out or book a demo today to discover how we can help you stay ahead of the latest export compliance trends.

To help companies manage their export compliance risk more effectively, there are solutions available for restricted party screening, export classification, license determination and management, and sanctioned party ownership screening, all of which can help organizations ensure they are not falling foul of the new and existing trade sanctions regulations.

See also what our customers are saying about our range of denied party screening solutions on G2, a third-party business software review website.