On September 29, 2025, the Bureau of Industry and Security (BIS) officially issued the long-anticipated BIS 50% Affiliates Rule, reshaping how U.S. companies and global exporters must approach trade compliance. What was once a proposed change is now enforceable—and it immediately extends U.S. export controls to a much wider set of counterparties.

This Interim Final Rule (IFR), also referred to as the BIS 50% Rule or the Affiliates Rule, closely parallels the widely recognized ownership-based sanctions enforced by the Office of Foreign Assets Control (OFAC) under the OFAC 50% Rule. With this new BIS rule, any entity that is 50% or more owned—directly, indirectly, or in aggregate—by parties on the Entity List, Military End-User (MEU) List, or certain OFAC Specially Designated Nationals (SDN) is now subject to the same Export Administration Regulations (EAR) licensing and restrictions as those owners.

This is not just another incremental update. The rule closes historical diversion gaps and puts the burden on businesses to uncover hidden ownership structures before moving goods, services, or technology. Inaction isn’t neutral—it’s risky. The cost of maintaining the status quo could mean strict-liability violations, denied export licenses, or reputational harm.

If your business operates internationally, the question isn’t whether the rule applies—it’s how quickly you can comply. Without automated ownership aggregation, continuous denied party screening, and auditable workflows, missed red flags are inevitable.

In our earlier article, “The BIS 50% Rule Is Coming,” we shared a readiness plan for ownership screening. Now that the rule is official, this article explains what changed, why it matters, and how the right export compliance technology can help your organization prevent penalties and protect revenue.

Key Takeaways

- The BIS 50% Affiliates Rule is now in effect. It reshapes how export control risks are defined, monitored, and managed across global supply chains.

- The core change is simple but far-reaching: ownership now triggers export control obligations under BIS 50%. Exports to affiliates 50%+ owned by listed parties are restricted even if those affiliates aren’t named.

- Closing diversion loopholes: The rule aligns BIS practice with OFAC’s 50% ownership restrictions.

- New export compliance obligations like Ref Flag 29 requires ownership investigation before completing a transaction or starting a shipment.

- Compliance is no longer about preparing, companies must act fast to update denied party screening practices, export licensing workflows, and recordkeeping.

What Changed with the BIS 50% Rule? How it Redefines Export Control Compliance

The BIS 50% Affiliates Rule is not just a technical adjustment—it’s a fundamental shift in compliance responsibility. For the first time, exporters must treat affiliates and subsidiaries owned 50% or more by restricted parties the same as if they were named directly on the BIS Entity List, MEU List, or certain OFAC sanctions programs.

That means ownership opacity is no longer a safe harbor. Companies now carry an affirmative duty to trace direct, indirect, and aggregated ownership before proceeding with exports, reexports, or technology transfers.

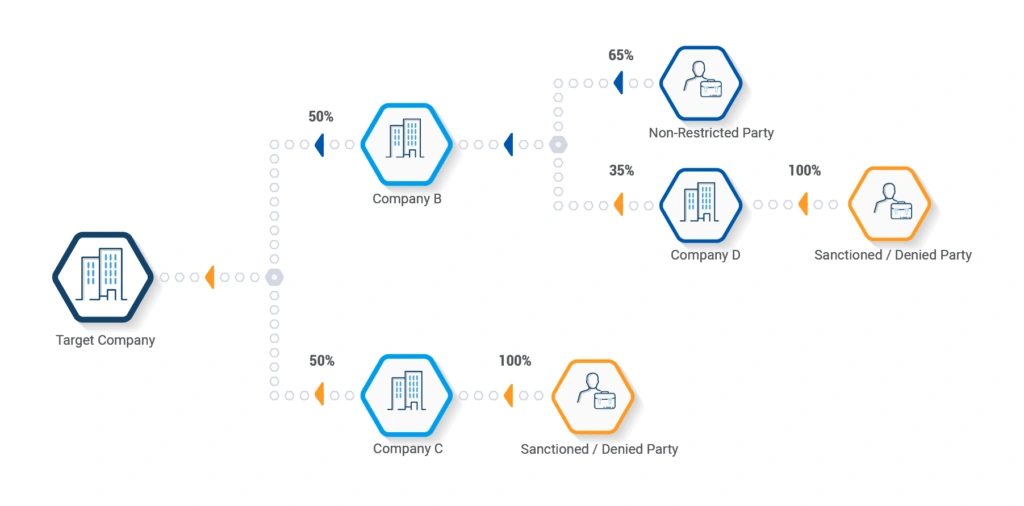

Image 1: How the BIS 50% Affiliates Rule Works — Restricted Party Ownership Structure

The logic is straightforward: if a parent company is restricted, its subsidiaries should not serve as back doors for acquiring sensitive U.S. technology, dual-use goods, or advanced components. By applying the BIS 50% ownership test, the regulator is extending the reach of export controls to capture entities that may have previously operated in the shadows.

As Undersecretary of Commerce for Industry and Security Jeffrey Kessler stated:

“For too long, loopholes have enabled exports that undermine American national security and foreign policy interests. Under this Administration, BIS is closing the loopholes and ensuring that export controls work as intended.”

This change introduces new compliance obligations, including enhanced due diligence, Red Flag resolution duties, and updated export license application procedures. Let’s take a closer look at these changes and why they matter for exporters.

Quick Facts About the BIS 50% Rule

What is the BIS 50% Rule?

It’s a new BIS requirement that extends export controls to any entity 50%+ owned by parties on the Entity List, MEU List, or specified SDNs—even if not explicitly named.

How does the BIS 50% Affiliates Rule trigger work?

Ownership is measured directly or indirectly and can be held individually or in aggregate across multiple listed parties.

What happens if ownership is unclear, unavailable or can’t be determined?

If the ownership structure cannot be resolved, the transaction must either be halted or proceed only with an export license application, unless a license exception applies.

Does the BIS 50% Rule apply worldwide?

Yes. It applies to exports, reexports, transfers (in-country), and certain foreign-direct product (FDP) scenarios globally.

How does it differ from OFAC’s 50% Rule?

It mirrors OFAC logic but applies under EAR, covering Entity List, MEU List, and SDN-related export controls.

For a deeper look at the origins of the Affiliates Rule, listen to this BIS 50 podcast session.

Scope and Framework of the BIS 50% Affiliate Rule

The BIS 50% Rule broadens compliance risk beyond named entities, requiring exporters to assess not just their direct counterparties—but who owns them, how much, and whether ownership is aggregated across multiple restricted parties.

- Coverage: BIS 50% applies globally, covering exports, reexports, and in-country transfers. It extends export controls to any entity majority-owned by listed parties on the Entity List, MEU List, OFAC-linked SDNs. Additionally, foreign-produced goods subject to the EAR may now fall under these expanded restrictions if linked to covered affiliates through ownership.

- End-User Review Committee (ERC) Discretion: The ERC —a multi-agency body within BIS— may list affiliates with <50% ownership if they pose a diversion risk or carve out specific affiliates if justified by national interest, licensing policy, or mitigating factors.

- Aggregation: Ownership percentages from multiple restricted owners combine to meet the 50% threshold.

- Exceptions: Some exclusions exist for entities tied only to address listings where actual owners aren’t identified on the Entity List. BIS notes that certain addresses pose diversion concerns, but entities at other locations may not carry the same risks.

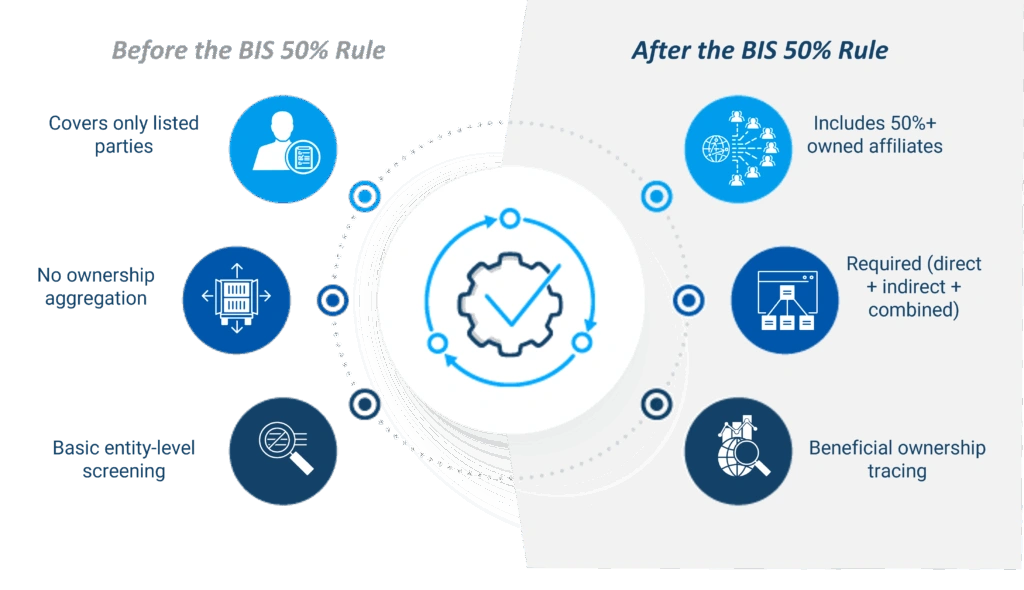

Image 2: BIS 50% Rule: Before vs. After Compliance Comparison

Export License Application and Recordkeeping Requirements

The BIS Affiliates Rule adds new procedural and documentation standards for export licenses: exporters must mark license applications with “Affiliates rule” when affiliates are involved, disclose listed owners and apply the most restrictive licensing logic when multiple restricted parties are present. Additionally, companies must retain detailed records of ownership checks, license filings, and resolution steps.

BIS 50% Red Flags, Due Diligence, and Ownership Transparency

BIS has introduced Red Flag 29, which creates an affirmative duty to investigate ownership when there is reason to believe a foreign party may be majority-owned by listed entities. If ownership cannot be determined, you must either resolve the ambiguity, obtain a BIS license, or identify a valid license exception before proceeding with the transaction. This marks a shift from passive denied party screening to active investigation. Businesses must now go beyond name-based checks and dig into ownership structures, aggregation logic, and control relationships.

Export Compliance Risks and Immediate Implications for Businesses

The Affiliates Rule took effect following publication in the Federal Register on September 30th. Under strict conditions, BIS issued a 60-day Temporary General License providing exporters with a short grace period to adapt. That adaptation will not be simple. Key areas of impact include:

Increased Compliance Obligations Under the BIS 50% Rule

The Affiliates Rule raises the compliance bar for exporters, creating new, enforceable compliance duties.

- Due diligence must extend deeper: regulators expect you to verify ownership chains and resolve aliases across affiliates, and monitor changes over time, making traditional denied party screening alone insufficient.

- Audit-ready documentation is essential: transactions must meet strict recordkeeping requirements. BIS will look for how companies determined ownership and applied the rule during enforcement reviews.

- Asses beyond the 50% threshold: BIS cautions against a narrow interpretation of the Affiliates Rule. Noting that while 50% ownership is the bright-line standard for automatic restrictions, risks arise from “significant minority ownership” or leadership connections to listed parties.

- Most-restrictive logic: if multiple listed owners are involved in a transaction, you must follow the strictest license requirements.

Expanded Exposure to Supply Chain Disruptions and Export Violation Risk

The BIS 50% Rule brings not only added compliance demands but greater exposure. Missed affiliate ties can lead to violations, penalties, and shipment delays while complex ownership checks drive export licensing, due diligence, and operational strain. Key risk categories:

- Strict liability: Even if you unknowingly export to an affiliate that falls under the 50% rule, you could face violations. BIS does not need to prove intent.

- Operational bottlenecks: Transactions may be delayed or canceled if ownership structures aren’t clarified quickly, adding cost and complexity to cross-border trade.

- Reputational and contractual risk when partner ownership structures are obfuscated.

Elevated Export License Volumes, Costs, and Complexity

With the BIS 50% Rule expanding licensing requirements and introducing new submission instructions, export license applications and appeals are expected to rise sharply. Exporters must prepare for a surge in license filing and investigation workloads, longer processing times, and higher compliance costs.

Heightened Vulnerability from Narrative Sanctions and Export Restrictions

Government screening lists are not exhaustive, that’s why the BIS 50% Affiliates Rule blends explicit list-based restrictions with narrative guidance. However, complying with narrative, implicit, or directional sanctions and export restrictions is increasingly complex. Unlike clear list entries, narrative sanctions require companies to interpret broad prohibitions—such as “military end use” or affiliates “owned or controlled” by restricted parties. Under BIS 50, exporters must navigate layered, opaque, and evolving export regulations with precision.

Strategic Imperative: How Companies Can Adapt to the BIS 50% Rule

The BIS 50% Rule leaves no room for weak links. Technology and expertise must work in tandem to close compliance gaps—strengthening denied party screening and tightening internal processes. What does this mean for compliance leaders and executives? Ownership intelligence and continuous screening must be embedded into broader enterprise risk management frameworks.

1. Reassess Current Restricted Party Screening Tools for Ownership Tracing

Why it matters: Traditional entity-level screening misses hidden risks. The BIS 50% Rule demands visibility into ownership hierarchies, indirect investors, and affiliated entities—especially in a landscape of shell companies and offshore structures.

Solution approach: Shift from static due diligence to continuous monitoring. Use tools that map corporate control, track ownership changes, and flag BIS-linked exposure in real time.

2. Connect Ownership Data to Compliance Action in Real Time

Why it matters: The rule requires uncovering direct, indirect, and aggregated ownership —at the same pace sanctions and export controls evolve. Manual registries and static lists alone aren’t fast or reliable enough.

Solution approach: Deploy denied party screening tools that automatically aggregate beneficial ownership, use enriched data to monitor affiliate risks, apply real-time global watchlist updates, and enforce the “most restrictive” rule for parties tied to Entity List, MEU, or SDN parties.

3. Embed Red Flag 29 Resolution into Compliance Workflows

Why it matters: Ensures compliance is enforced before exposure occurs. BIS expects exporters to resolve opacity in ownership structures. “We couldn’t find it” is not a defense.

Solution approach: Implement Red Flag 29 triggers within your denied party screening software to automatically escalate affiliate risks, document due diligence, and block shipments until resolved.

4. Strengthen Export License Application Processes

Why it matters: License submissions now require ownership narratives and proof of diligence. Ambiguous ownership could mean repeated denials.

Solution approach: Use export license management software to standardize application templates, centralize licensing records, and automate audit trails that capture search sources, findings, and decision rationale.

5. Integrate Compliance with ERP, CRM, Procurement, and Other Business Systems

Why it matters: Time-sensitive decisions define resilience. Waiting for ownership insights slows operations while manual checks create inconsistency, risking compliance blind spots across onboarding, orders, payments, and shipments.

Solution approach: Integrate denied party screening into Enterprise Resource Planning (ERP), Customer Resource Management (CRM), and procurement workflows to automate checks at every critical touchpoint—ensuring speed, accuracy, and scalable compliance.

6. Centralize Recordkeeping and Export Documentation

Why it matters: Loose records = tight penalties. Under Part 762 of the EAR, incomplete documentation can undermine compliance. Without clear ownership evidence and resolution rationale, companies risk audit failures and enforcement actions.

Solution approach: Your export compliance software should centralize BIS‑748P license submissions and denied party screening records, track key risk metrics, and document sources, findings, and decisions—ensuring all compliance data is complete, searchable, and retained in full alignment with BIS 50% requirements.

7. Revise Export Compliance Policies and Educate Teams Across Functions

Why it matters: Sales, logistics, procurement, and finance teams may all interact with counterparties affected by the Affiliates Rule. Awareness ensures that compliance insights inform business decisions at every level and prevents accidental violations.

Solution approach: Deliver cross-functional training focused on recognizing signals of opaque or aggregated ownership, escalating cases, and using automated trade compliance tools.

8. Partner with an Export Compliance Technology Provider

Why it matters: The BIS 50% Rule is complex, and enforcement will only intensify. Having the right technology and support in place reduces risk and speeds up compliance.

Solution approach: Solutions like Descartes’ denied party screening platform help automate affiliate checks, resolve red flags, and provide consistent compliance support—giving organizations confidence in a high-risk environment.

Protect Your Supply Chain with Descartes BIS 50% Compliance Solution

The BIS 50% Affiliates Rule represents one of the most significant expansions of U.S. export control enforcement in recent years. By extending restrictions to entities owned 50% or more by listed parties, BIS has effectively redrawn the compliance map.

While the rule drives higher license volumes, longer timelines, and added resource demands, it also creates a strategic opportunity. With the right tools, compliance leaders can turn ownership transparency into resilience, reduce bottlenecks across sales, procurement, and logistics, and strengthen customer trust in a more demanding global trade environment.

Request a demo to see how Descartes Visual Compliance can help you screen smarter, faster, more accurately, and gain full visibility into ownership structures.

Find out what our customers are saying about Descartes Denied Party Screening on G2 – an online third-party business software review platform. Additionally, you can read this essential buyer’s guide to denied party screening to help you select a solution that fits your needs.