The Bureau of Industry and Security (BIS) has proposed a BIS 50% rule which represents one of the most significant updates to U.S. export control enforcement in recent years.

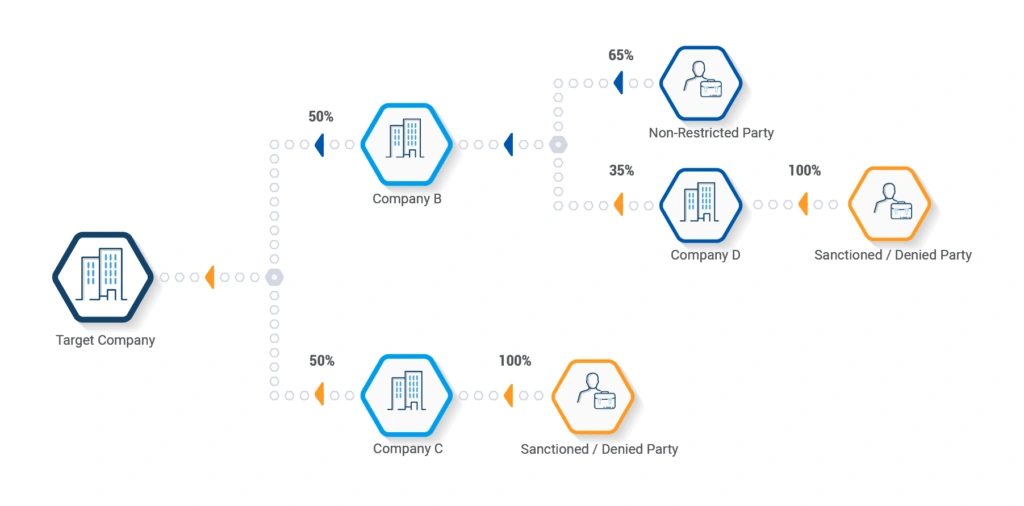

Under the new rule, any organization that is 50% or more owned (directly or indirectly) by one or more parties on the BIS Entity List may soon be treated as restricted, even if the entity is not named explicitly. This change would dramatically expand the scope of export controls and affect thousands of companies across global supply chains.

By closing the long-standing ownership loophole, the BIS aims to prevent sanctioned parties from using front companies, subsidiaries, shadow entities, and complex corporate structures to evade trade controls. The implications are far-reaching as this rule could introduce new risks overnight, adding layers of complexity to trade compliance.

While the rule is still in draft form, enforcement is not a question of if, but when. For exporters, suppliers, manufacturers, freight forwarders, and export compliance professionals, this means one thing: prepare now. Waiting until the rule goes into effect invites regulatory penalties, export violations, and costly shipment delays.

To stay compliant and competitive, businesses need to implement robust denied party screening tools with deep sanctioned party ownership intelligence that can detect indirect links to Entity List designees.

Key Takeaways

- The BIS 50% rule, similar to one from the Office of Foreign Assets Control (OFAC), would restrict entities owned 50% or more by one or more parties on the BIS Entity List.

- It closes a critical loophole that allows restricted parties to operate through unnamed affiliates.

- Companies must expand their denied party screening to account for ownership structures and indirect control.

- Delayed action increases the risk of export violations, operational delays, and reputational harm.

- Now is the time to update systems, training, and due diligence processes to meet evolving export compliance requirements.

What is the BIS 50% Rule? Ownership-Based Export Controls Explained

The proposed BIS 50% rule would expand the definition of a restricted party under U.S. export control laws. Once finalized, it would restrict any entity that is 50% or more owned, directly or indirectly, by one or more parties on the BIS Entity List, even if that entity is not named.

Currently, restrictions apply only to named parties. This has allowed some listed entities to continue procuring sensitive goods through affiliates or subsidiaries. BIS refers to this as the “whack-a-mole” problem.

Image 1: Sanctioned Ownership Structure – How a non-listed entity can become a restricted party under BIS 50% rule

Key Elements of the Proposed BIS 50 Rule

Modeled after the Department of Treasury’s OFAC 50% rule—which has long treated majority-owned subsidiaries of sanctioned entities as sanctioned, even when not named individually—the BIS version introduces several critical enhancements:

- Indirect ownership: Apply restrictions to entities with layered, multi-tiered, or shell ownership structures.

- Ownership aggregation: Combine partial ownership by multiple listed entities to meet the 50% threshold. For example, if two Entity List parties each hold a 25% stake in a company, that company would be treated as restricted.

- Automatic designation: Entities meeting the ownership criteria would be immediately restricted without needing to be named on the BIS Entity List.

| Section | OFAC 50% Rule | BIS 50% Rule (Proposed) |

|---|---|---|

| Rule Status | Established | Pending finalization |

| Trigger Threshold | ≥50% ownership | ≥50% combined ownership by listed parties |

| Ownership Type | Direct + indirect | Direct + indirect |

| Aggregation Rule | Yes—ownership by multiple listed parties | Yes—multiple partial stakes aggregated |

| Entity Designation | Automatic—even if not listed by name | Automatic—even if not listed by name |

| Impacted Activities | Financial transactions, services | Export, re-export, and transfer of goods |

| Main Risk Area | Sanctions evasion through subsidiaries | Export diversion via ownership loopholes |

Table 1: Comparison of OFAC vs. BIS 50% ownership rules

So why is BIS closing the loophole now? The goal is to align trade compliance with sanctions enforcement and prevent diversion, particularly involving entities linked to military modernization efforts in China and Russia.

Additionally, strengthening enforcement by eliminating the need for time-consuming case-by-case designations. A 2023 report by the U.S. House Foreign Affairs Committee called the current BIS list ineffective without ownership tracing. This rule is BIS’s answer, and a signal of more aggressive enforcement to come.

The Export Compliance Impact of the BIS 50% Rule

The proposed BIS 50% rule will fundamentally reshape how companies—especially in global trade, tech, and advanced manufacturing—manage export compliance. Once in force, this rule will demand deeper ownership due diligence, broader screening, and faster response to regulatory changes. Key areas of impact include:

1. Expanded Scope of Denied Party Screening

The rule will require screening for ownership links, not just name matches. Companies must trace corporate connections across parent companies, affiliates, and secondary investors. Export compliance programs without ownership-aware screening systems to detect these indirect relationships increase the chance of missing restricted entities. At the same time, the expanded scope may lead to a surge in false positives—especially for organizations relying on legacy screening tools. Without precise sanctioned ownership data and contextual filters, systems may flag entities with similar names or partial matches, overwhelming compliance teams and slowing down legitimate transactions.

2. Increased Export Violation Risk from Hidden Ownership Links

Without tools for sanctioned ownership mapping, businesses risk unknowingly violating export laws. Opaque structures and offshore holdings make it difficult to identify indirect control, especially across borders. The consequences of missing an ownership link? Costly fines and enforcement actions, blocked shipments or revoked export privileges, and long-term reputational harm.

3. Operational Disruptions for Sensitive Goods

Industries dealing with dual-use technologies, semiconductors, telecom, or aerospace components may face delays as they work to verify ownership compliance. Even one missed link can impact revenue and customer trust. Without fast, accurate restricted party screening capabilities, businesses risk interruptions in export licensing or supply chain approvals, late shipments to critical customers, disruptions in sourcing or procurement.

4. Heavier Due Diligence Burden

The BIS 50% rule raises the bar for what’s considered “reasonable” due diligence. Companies will need to:

- Map and monitor ownership and control chains.

- Track mergers, acquisitions, divestments, and investments in real time.

- Maintain audit-ready records across jurisdictions to prove compliance during inspections.

What was once a quarterly task now becomes an ongoing obligation, especially in high-risk markets.

5. Geopolitical and Retaliatory Risks

Countries affected by expanded U.S. restrictions, targeted countries—especially China and Russia—may respond with countermeasures or blacklist U.S. companies in retaliation. This may complicate cross-border supply chain stability, market access for U.S.-based exporters and strategic partnerships and foreign investments. Global companies must prepare for risk on multiple fronts: regulatory, operational, and geopolitical.

How to Prepare: Your 5-Point BIS 50% Rule Readiness Plan

With the BIS 50% Rule expected to become law soon, businesses must act now—not later. This five-step readiness plan will help strengthen your export compliance program and keep your organization ahead of the curve.

Review Your Denied Party Screening Tools for Ownership Tracing

Many existing denied party screening software only flag exact name matches. That’s not enough under the BIS 50% rule. You’ll need solutions that can:

- Detect ownership and control links—both direct and indirect.

- Recognize aggregated ownership stakes across multiple restricted parties.

- Flag unnamed entities that still fall within the rule’s scope.

Look for solutions that incorporate specialized secondary data sources and can model nested ownership relationships. These capabilities are essential for complying with narrative-based rules, such as BIS 50 and OFAC’s 50% rule.

Deepen your Due Diligence Coverage

The rule requires a broader lens when evaluating customers, vendors, and partners. Traditional entity-level screening is not sufficient. Businesses must map out:

- Corporate structures and control hierarchies.

- Shareholders, beneficial owners, and indirect investors.

- Any affiliated or subsidiary entities with exposure to the BIS Entity List.

In today’s environment of shell companies and offshore entities, due diligence must evolve from static snapshots to continuous monitoring.

Integrate Compliance with ERP, CRM, Procurement, and Other Business Systems

Manual checks slow down business and create inconsistency. By integrating trade compliance into your existing ERP, customer resource management (CRM), sales, procurement, and sourcing workflows, you ensure that denied party list checks happen at every critical point:

- Onboarding new customers or suppliers.

- Booking orders.

- Processing payments.

- Shipping or exporting goods.

- Managing recurring business relationships.

Automation reduces delays and ensures scalable compliance, especially when you follow best practices for integrated denied party screening.

Update Export Compliance Policies and Train Internal Teams

Your internal compliance policies should explicitly reflect the broader scope of the BIS 50% rule and clearly define roles and responsibilities for screening, ownership tracing, and escalation. Training should go beyond awareness. Equip the compliance team, as well as the procurement, sales, legal, and logistics teams with practical knowledge on:

- Identifying red flags in ownership structures.

- Escalating suspicious parties or affiliations.

- Using denied party screening tools correctly and consistently.

- Maintaining documentation standards for audit readiness.

Partner with a Trusted Compliance Technology Provider

Spreadsheet-driven due diligence isn’t recommended under the BIS 50% rule. The proposed law introduces data volume, structural complexity, and frequent updates that manual tools simply can’t handle, especially when screening ownership information for multinational entities.

A trusted export compliance technology partner can help you:

- Monitor emerging sanctioned ownership risks and evolving rule language using enriched, real-time data.

- Stay informed about enforcement timelines and regulatory updates from BIS.

- Implement artificial intelligence (AI)-enabled tools that reduce false positives and streamline investigations.

- Be audit-ready without draining your internal resources.

- Provide regular training and knowledge resources to your compliance teams.

How Descartes Helps Export Compliance Teams Stay Ahead of the BIS 50% Rule

Descartes offers a suite of export compliance tools designed to address the expanding scope of denied party screening, ownership tracing, and regulatory change. Below are key platform capabilities that support readiness and resilience as the BIS 50 rule moves toward enforcement.

- Comprehensive Sanctioned Ownership Screening: Descartes Visual Compliance™ provides specialized screening content that enables organizations to identify hidden ownership risks across both sanctions and export control regimes. This includes coverage of the proposed BIS 50 percent rule, OFAC 50% rule, Uyghur Forced Labor Prevention Act (UFLPA), Military End Use, Politically Exposed Persons (PEP), and other frameworks that require layered due diligence. Our integration with Kharon—a leader in sanctioned ownership and risk intelligence—enables deeper visibility into corporate structures and ownership chains that may otherwise go undetected. Explore our approach to sanctioned party ownership screening.

- Real-time Entity List and Restricted Party List Updates: Descartes maintains an extensive and frequently updated global denied party list database, ensuring you’re screening against the most current information available from governments, regulators, and enforcement agencies worldwide.

- Dynamic Denied Party Screening Across the Organization: Our solution connects compliance, sales, procurement, and IT for consistent screening company wide. Screening can be seamlessly integrated at key touchpoints such as onboarding, order creation, and shipment release, ensuring compliance without disrupting operations. To further reduce risk, dynamic rescreening automatically checks existing records against updated denied party lists—catching newly listed entities. Combined with automated compliance management workflows, this approach enables proactive enforcement and audit-ready transparency across all departments.

- Enhanced accuracy with AI-driven sanctions screening: Descartes Visual Compliance AI Assist uses artificial intelligence to reduce false matches caused by ambiguous names, similar spellings, and unclear ownership structures. By minimizing false positives, compliance teams can resolve potential issues faster and focus their attention where it matters most. Learn how Descartes Visual Compliance AI Assist reduces false positives by up to 60%.

Simplify Sanctioned Party Ownership Screening and BIS 50% Rule Compliance with Descartes

The BIS 50% rule isn’t just another regulatory update—it’s a paradigm shift. Waiting until enforcement starts is too late. Future-proof your compliance program today to avoid operational chaos, legal penalties, and lost business tomorrow.

If your export compliance program only screens for named entities, you’re missing a rapidly-growing area of risk. The BIS 50% Rule will make ownership tracing mandatory, not optional. Need help evaluating your readiness for the BIS 50% Rule? Request a demo to see how Descartes Visual Compliance can help you screen smarter, faster, more accurately, and gain full visibility into ownership structures.

Find out what our customers are saying about Descartes Denied Party Screening on G2 – an online third-party business software review platform. Additionally, you can read this essential buyer’s guide to denied party screening to help you select a solution that fits your needs.