Complying with Office of Foreign Assets Control (OFAC) regulations depends on more than screening transactions against sanctions lists. Accurate OFAC reporting and disciplined recordkeeping are core pillars of a strong sanctions compliance program, and enforcement actions over the past several years make that expectation increasingly clear.

In multiple cases, OFAC has imposed penalties not solely because prohibited transactions occurred, but because organizations failed to maintain complete records, submit timely reports, or demonstrate effective internal controls tied to sanctions obligations. One example is the recent $7.1 million penalty issued to a New York property management company for failing to report blocked assets.

These outcomes reflect OFAC’s broader shift toward data-driven enforcement, where the strength of an organization’s reporting controls is used as a direct indicator of its governance, escalation practices, and compliance culture. Now, the ability to demonstrate how compliance decisions were made is just as important as the decisions themselves.

OFAC’s evolving expectations—reinforced by the 2024-2025 updates to the Reporting, Procedures and Penalties Regulations (RPPR), including extended 10-year record retention requirements and mandatory electronic filing through the OFAC Reporting System (ORS)—make it essential for organizations to ensure their OFAC compliance programs can support these obligations consistently and at scale.

As the regulatory environment becomes more complex, outdated or manual processes place organizations at real risk. Comprehensive reporting and long-term OFAC record retention now require structured workflows, system-level controls, evidence preservation, and tools capable of producing clear, complete, and retrievable records on demand. These capabilities are no longer a back-office function; they are a critical component of sanctions risk management.

In This Article:

- Why OFAC Reporting and Recordkeeping Matter More Today

- What Reporting Failures Signal About OFAC Compliance

- How Strong Records Support the OFAC Compliance Lifecycle

- What OFAC Reporting and Recordkeeping Actually Require

- Enforcement Actions for OFAC Reporting and Recordkeeping Failures

- How Delayed OFAC Reporting Became a $7.1 Million Penalty

- Where Organizations Struggle with OFAC Reporting

- How OFAC Screening Software Fixes Reporting Challenges

Why OFAC Reporting and Recordkeeping Matter More Than Ever

More complex sanctions programs, longer investigative timelines, and the agency’s move toward data-driven enforcement are some of the drivers of change in OFAC reporting and documentation expectations.

The Reporting, Procedures and Penalties Regulations (RPPR) are not administrative checklists, they now serve as a direct window into an organization’s compliance culture. How well the RPPR obligations are met are indicators of whether a sanctions compliance program actually works. When reports are late, incomplete, or missing, OFAC increasingly treats those failures as evidence of broader compliance weaknesses, not isolated errors.

Reporting Failures Signal Weak OFAC Compliance Culture and Controls

In recent enforcement actions, OFAC has made clear that reporting breakdowns often point to deeper systemic issues, including:

- Gaps in internal controls: Absent or inconsistent reports suggest that required checks were not followed or monitored. Missing timestamps, incomplete audit trails, or undocumented reviews can indicate that sanctions risks were not identified and addressed in a timely manner.

- Inadequate OFAC screening procedures: When screening systems fail to capture relevant parties, ownership structures, or OFAC 50 Percent Rule exposure, reporting errors often follow. If screening activities are undocumented, organizations cannot prove that they evaluated risk appropriately.

- Poor escalation and case management: Gaps in records often uncover unclear decision-making paths or missed internal reviews. When case files lack reviewer notes, decision rationale, or evidence of internal approvals, it raises concerns that alerts were dismissed without proper analysis or that escalation protocols were inconsistently applied.

- Governance and data management weaknesses: Fragmented systems or manual processes often produce incomplete or conflicting information, raising red flags during investigations.

From OFAC’s perspective, a failure to report is rarely viewed in isolation—it raises questions about how risks are identified, evaluated, and managed across the organization.

Strong Records Support the Entire OFAC Compliance Lifecycle

Documentation plays a role in every stage of OFAC sanctions compliance, not just after an issue has been identified. Records enable compliance teams and regulators to trace decisions, validate controls, and confirm that risks were managed appropriately. OFAC expects organizations to demonstrate—not reconstruct—the rationale behind their determinations. That includes recordkeeping across the full lifecycle.

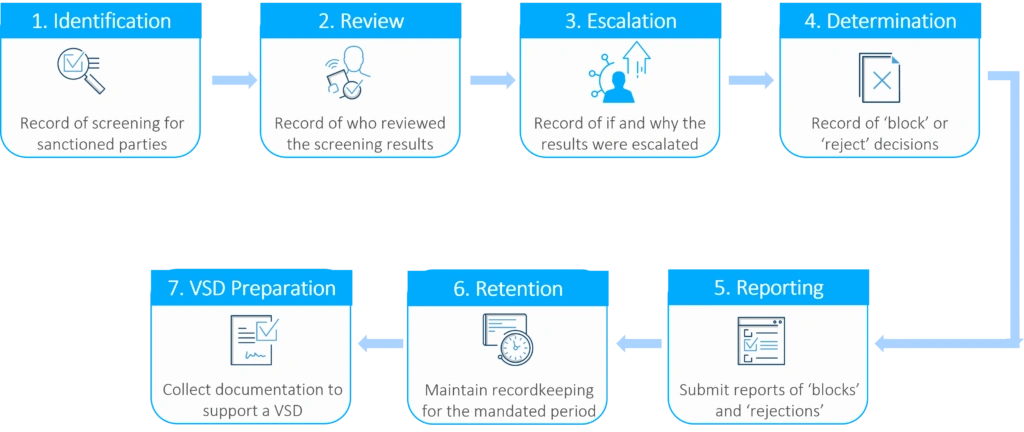

Figure 1. How Recordkeeping Fits into Key OFAC Compliance Processes

- Identification: Records show how transactions and counterparties were screened, what sanctions lists and tools were used (sanctions screening software or OFAC search tool).

- Escalation: Documentation captures how screening results were reviewed, who made escalation decisions, and what information informed those decisions.

- Determination (block vs. reject): Records demonstrate why a property was blocked or a transaction rejected and how the organization assessed and mitigated risk.

- Reporting: Each determination must be reflected accurately and timely in formal submissions to OFAC to meet the initial 10-day reporting and annual blocked property reports.

- Record retention: Under the expanded 10-year standard, these materials must remain complete, intact, and fully retrievable.

- Voluntary Self-Disclosure (VSD) preparation: High-quality documentation is central to assessing the scope of an incident and preparing supporting materials if a VSD is warranted.

Without structured records at each step, organizations struggle to meet reporting deadlines, defend compliance decisions, or demonstrate good-faith efforts during an enforcement review.

Reporting and Recordkeeping at the Core of OFAC’s Enforcement Model

OFAC operates in a data-driven enforcement environment. Blocked property reports, rejected transaction reports, and supporting documentation allow the agency to identify sanctions evasion patterns, assess systemic risk, and prioritize investigations. As a result, OFAC has repeatedly emphasized the importance of complete, accurate, and consistent reporting.

Errors, omissions, or inconsistencies don’t just delay compliance—they increase scrutiny and can escalate penalties. OFAC has also highlighted the growing role of whistleblowers in uncovering sanctions violations, which makes internal transparency essential. When reporting workflows and recordkeeping systems are fragmented or manual, employees may lack clear paths to escalate concerns, and organizations may lack the evidence needed to respond effectively.

What OFAC Reporting and Recordkeeping Actually Require

OFAC’s Reporting, Procedures and Penalties Regulations have evolved to set clearer—and more demanding—expectations around how sanctions-related activity is documented, reported, and retained. The RPPR updates emphasize that reporting and recordkeeping are not optional or institution-specific obligations; they are foundational requirements for all U.S. persons and entities subject to U.S. jurisdiction.

- Key Reporting Requirements and Deadlines

Organizations must be able to identify, document, and report sanctions-related activity within strict timelines:

- Blocked Property Reports

- Initial reports must be filed within 10 business days of blocking property.

- Annual reports are required for any property that remains blocked as of June 30 each year.

- Rejected Transaction Reports are within 10 business days of rejection.

- Transfers and Unblocking of Blocked Property: any transfer, release, or unblocking of previously blocked property must also be reported promptly to OFAC

- Mandatory Electronic Filing Through the OFAC Reporting System

OFAC now requires that all sanctions reports, including initial and annual blocked property reports and rejected transaction reports, be submitted electronically through the ORS. This shift increases OFAC’s ability to analyze data at scale, identify patterns of sanctions evasion, and cross-reference reports across institutions and industries

- Recordkeeping and Retention Obligations

OFAC now requires organizations to retain all sanctions-related records for 10 years, including:

- OFAC screening results and alert data

- Internal reviews, escalation decisions, and approvals

- Reports submitted to OFAC

- Transactions conducted under general or specific licenses

These records must be readily retrievable and furnished upon request, even when transactions were ultimately authorized. In practice, this means organizations must maintain complete audit trails that extend well beyond transaction execution.

- Scope of Reporting Obligations

OFAC has reinforced that reporting and recordkeeping obligations apply broadly to all U.S. persons and entities subject to U.S. jurisdiction, not just banks or financial institutions.

In recent commentary, OFAC has noted low reporting rates among non-financial entities, signaling increased scrutiny ahead for manufacturers, logistics providers, exporters, technology firms, and others that may incorrectly assume sanctions reporting is someone else’s responsibility.

Bottom line: OFAC’s expectations now demand timely reporting, electronic submission, long-term record retention, and enterprise-wide visibility. Organizations that lack structured workflows, centralized data, and automated reporting capabilities are increasingly exposed—not only to violations, but to enforcement escalation driven by documentation failures.

Enforcement Actions Show How Recordkeeping Failures Become OFAC Violations

While standalone RPPR enforcement actions remain relatively rare, OFAC has made one point increasingly clear through recent cases: when reporting and recordkeeping fail, penalties escalate quickly. The enforcement cases we explore below show that OFAC does not view documentation lapses as administrative errors but systemic compliance weaknesses.

Delayed OFAC Reporting Turns into a $7.1 Million Penalty

In one of the clearest examples of how recordkeeping failures evolve into violations, a New York–based property management company failed to report blocked property for more than 45 months, resulting in a $7.1 million penalty. OFAC cited multiple breakdowns that compounded over time:

- Failed escalation: Blocked property was identified but not elevated for reporting.

- Lack of ongoing monitoring: No controls existed to ensure blocked assets were reviewed and reported on a recurring basis.

- Inaccurate or incomplete records: The company could not produce consistent documentation to explain how blocked property was tracked.

- Missed filing obligations: Initial and annual blocked property reports were not submitted in a timely manner.

Missing and inconsistent documentation significantly amplified the severity of enforcement, transforming what began as a reporting failure into a multimillion-dollar penalty.

Inaccurate Reporting and Weak Record Maintenance by an International Finance Firm

In this case, OFAC issued a Finding of Violation (FoV)—rather than a monetary penalty—after determining the institution violated RPPR requirements by:

- Failing to maintain complete and accurate records of blocked property.

- Submitting inaccurate reports to OFAC.

- Engaging in transactions involving blocked property without obtaining required specific licenses.

Although no fine was imposed, OFAC emphasized that accurate reporting and robust record maintenance are mandatory, not discretionary. The case highlights how human error, inconsistent documentation, and fragmented data can still trigger enforcement actions—even when underlying sanctions exposure appears limited.

Siloed Reporting and Manual Processes Created Blind Spots for a U.S. Payment Card Services Corporation

The company failed to report dormant accounts tied to newly sanctioned banks, revealing limitations in manual reporting processes. OFAC highlighted how stronger OFAC screening software and centralized visibility could have prevented the lapse. Key failures included:

- Dormant accounts were still considered blocked property but were not reported.

- Siloed systems and manual processes prevented detection and escalation.

- Internal control gaps persisted despite the organization’s size and sophistication.

OFAC specifically noted that these failures impaired its ability to report accurately to Congress, underscoring how reporting gaps extend beyond the company and affect OFAC’s broader enforcement mission.

The Common Thread: Where Organizations Struggle with OFAC Reporting

Across these cases, the violations were not driven solely by prohibited transactions but by areas where many organizations face persistent challenges in meeting OFAC’s expectations:

- Fragmented Data Sources: ERP, banking, trade docs, and compliance tools not fully integrated as such compliance data is scattered across emails, shared drives, and ticketing systems

- Manual Reporting Processes: Preparing and submitting reports manually increases the risk of late filings, incomplete data, and inconsistencies across submissions.

- Inconsistent OFAC Screening Practices: No standardized process for denied party screening cadence or escalation protocol for potential matches.

- Poor Documentation & Audit Trails: Organizations may screen effectively but fail to document why a match was cleared or escalated, leaving critical gaps during audits.

- Unclear “Block vs. Reject” Handling and Tracking Rules: Staff unsure when to block, when to reject, and what constitutes “property” or “interest in property.” Additionally, limited visibility into aging, changes, or updates tied to previously identified risks. Leads to improper handling—one of the main drivers of enforcement cases.

- Disconnected Workflows and Data Quality Deficiencies: Sanctions events involve multiple teams—Procurement, Sales, Legal, Logistics, and Operations—but the lack of a centralized system leads to missed events, late reporting, incomplete customer data for ownership checks or 50 Percent Rule exposure, and no single source of truth for counterparty information.

- Difficulty Meeting Long-Term Retention Requirements: Legacy systems were not designed to retain compliance records securely and accessibly for a decade or longer.

How OFAC Screening Software Fixes Reporting and Documentation Challenges

OFAC’s reporting and recordkeeping expectations are no longer compatible with manual processes, spreadsheets, or fragmented systems. As reporting volumes increase, retention periods lengthen, and electronic filing becomes mandatory, technology has become the backbone of any defensible OFAC compliance program.

Effective OFAC compliance software directly maps to regulatory obligations and addresses the exact failure points seen in enforcement actions:

Automated Report Generation

Software-driven OFAC reporting provides support for electronic submission via the ORS. Reduces risk of human error, missed deadlines and incomplete filings by easily generating relevant OFAC screening details, standardizing report formatting, and streamlining submissions.

Centralized OFAC Record Retention Management

A single system of record for all sanctions-related activity stores denied party screening results, transaction data, reports, OFAC licenses, and communications in one place. Built-in retention policies apply the 10-year recordkeeping rules automatically and eliminates reliance on individual employees or shared drives.

Immutable Audit Trails

OFAC compliance platforms create immutable audit trails that:

- Capture timestamps, user actions, and decision points

- Preserve evidence of reviews, escalations, and approvals

- Demonstrate how compliance decisions were made

Since Enforcement actions often hinge on what a company can prove, these audit logs are critical when responding to regulators, auditors, or enforcement inquiries.

Integrated Screening and Documentation

Disconnected screening tools make it difficult to reconstruct why a transaction was blocked, rejected, or cleared. Integrated OFAC search tools turn fragmented data into a single source of truth by linking denied party screening directly to counterparty and transaction records in ERP, CRM, and other business systems. This provides a complete compliance narrative for each transaction.

Workflow Automation That Enforces Compliance Steps

OFAC compliance software encourages consistent application of internal controls. Enforces required steps (screen → escalate → adjudicate → document → report → retain). The platform prevents risky transactions from advancing without proper review and ensures documentation is created at each stage.

Advanced Search, Fast Record Retrieval, and Regulatory Response

When OFAC requests information, response time and completeness matter. Robust OFAC compliance platforms offer:

- Advanced search across transactions, parties, and reports

- Filters by date, sanction program, counterparty, or status

- Fast retrieval of historical records and view of past remediation steps

This capability is essential for regulatory audits and voluntary self-disclosures.

Prevent Costly OFAC Reporting Violations and Strengthen Compliance with Descartes

OFAC enforcement actions make one point clear: reporting and recordkeeping are no longer administrative afterthoughts, they are core compliance controls. Missed filings, incomplete records, and undocumented decisions now carry real enforcement risk. In an enforcement environment where regulators increasingly assess how compliance decisions are made and recorded, technology is what turns intent into proof.

Descartes helps companies operationalize OFAC compliance through integrated, centralized platforms that securely store, access, and audit records with confidence. Real-time screening, automated reporting, and continuous compliance checks reduce risk at every stage, while advanced data security safeguards sensitive information.

Descartes Visual Compliance with AI Assist further strengthens compliance by leveraging OFAC screening data to reduce false positives—identifying low-risk matches so teams can focus their expertise where it matters most.

Ready to turn OFAC Reporting & Recordkeeping Into a defensible control? Request a demo today and see how Descartes can strengthen your OFAC compliance program before gaps become violations.

Find out what our customers are saying about Descartes Denied Party Screening on G2 – an online third-party business software review platform. Additionally, you can read this essential buyer’s guide to denied party screening to help you select a solution that fits your needs.