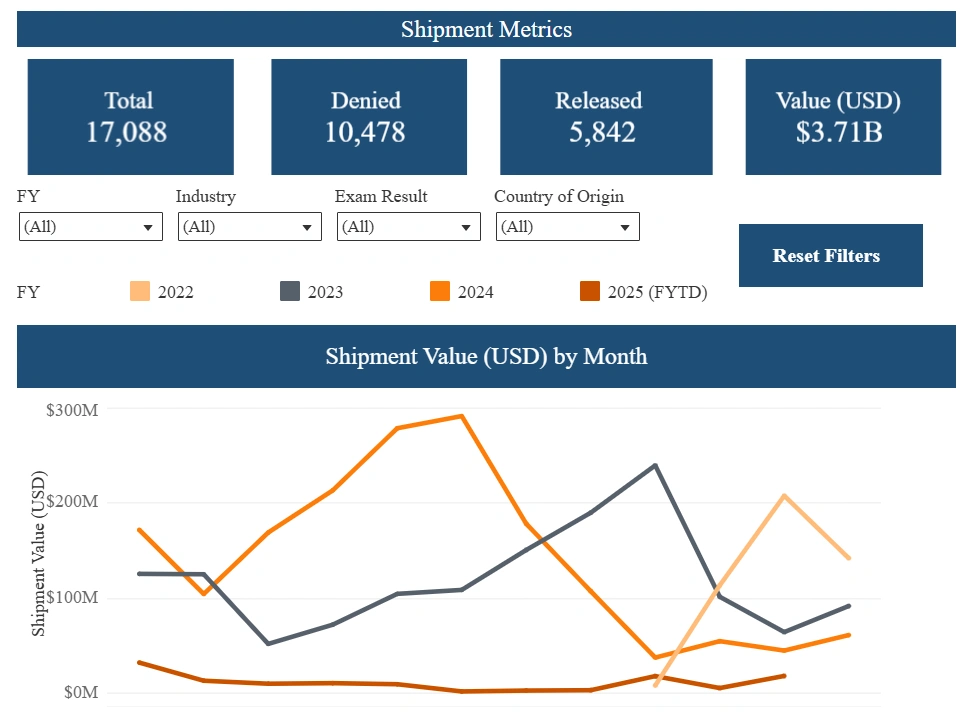

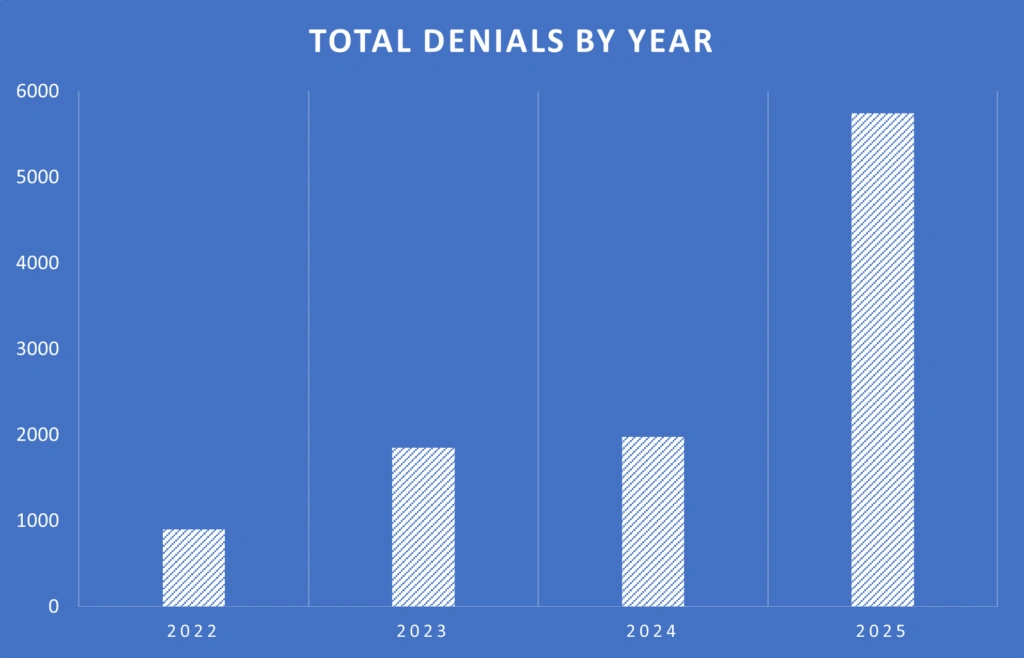

Forced labor in global supply chains has shifted from an ethical concern to a frontline trade compliance and enforcement challenge. In its third year, the Uyghur Forced Labor Prevention Act (UFLPA) continues to reshape global trade, with U.S. Customs and Border Protection (CBP) detaining over 17,000 shipments, worth more than $3.7 billion, since enforcement began. The pace is accelerating, between January and September 2025 alone, 5,745 shipments were denied—a 21% increase over the combined total from 2022 to 2024.

And the U.S. isn’t acting in isolation. Canada, the UK, Germany, and the EU have moved toward mandatory forced labor due diligence, signaling a worldwide shift from voluntary transparency to enforceable accountability. In this environment, manual questionnaires and supplier attestations are no longer enough. Companies must upgrade to automated supply chain compliance software capable of continuous supplier screening, traceability, and defensible documentation.

As global forced labor regulations tighten and enforcement expands, businesses need more than policy statements; if you can’t prove your supply chain is free from forced labor, regulators will assume it isn’t. This article explores how enforcement is evolving, where companies are most exposed, and how leading organizations are using supply chain compliance technology to prevent disruption, strengthen resilience, and safeguard brand trust.

Key Takeaways

- UFLPA enforcement is tightening, with detainment and denial rates spiking throughout 2025.

- The automotive sector now accounts for nearly a third of all detained shipments.

- Forced labor due diligence laws in the EU, Canada, and other regions are reshaping global trade compliance requirements

- Layered supply chains demand visibility beyond Tier 1, especially in high-risk regions.

- Supply chain compliance software enables real-time screening, traceability, and defensible audit records to stay ahead of enforcement trends.

- The cost of a delayed or denied shipment often exceeds the investment in compliance automation.

UFLPA Enforcement at Year 3: Key Trends and Insights

Enacted in June 2022, the UFLPA creates a rebuttable presumption that any goods made wholly or in part in China’s Xinjiang region are the product of forced labor and therefore banned from entering the U.S. unless importers can prove otherwise.

To operationalize this, the CBP enforces the law through detentions, denials, and the expanding UFLPA Entity List, which identifies companies and facilities linked to forced labor. In August 2025, CBP published significant updates to its UFLPA enforcement strategy.

With more than three years of activity now on record, the data tells an important story—one of expanding risks, broader supply chain exposure, and rising expectations for UFLPA compliance. Let’s take a closer look at what the numbers reveal.

UFLPA Detentions Continue to Climb

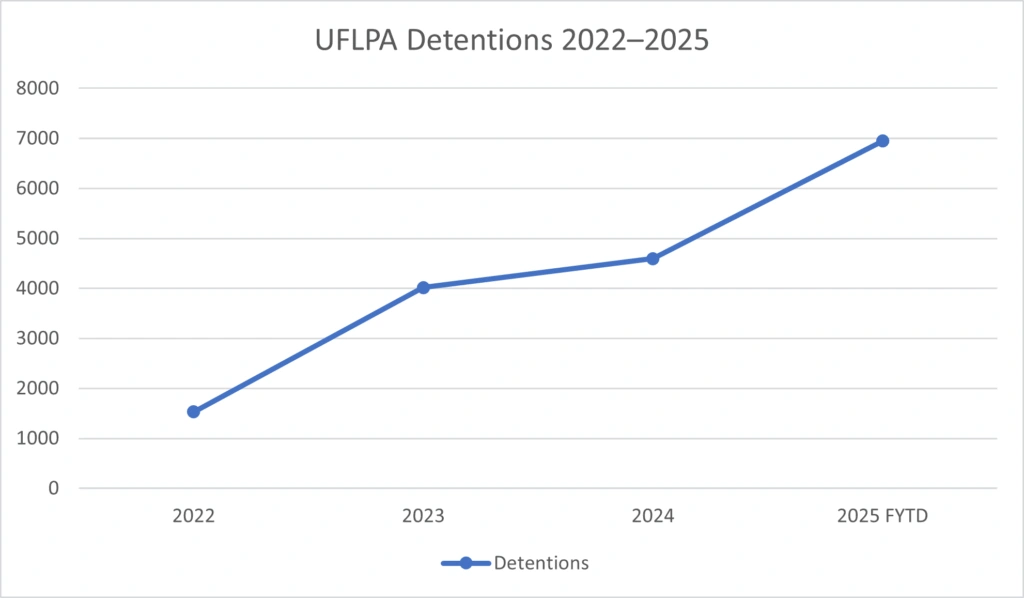

CBP’s enforcement curve continues to rise. Detentions under the UFLPA more than doubled from 1,529 in 2022 to 4,016 in 2023, a 163% increase. They climbed another 14% in 2024 before surging 51% in 2025, bringing the total to 6,946 shipments this year alone. The cumulative picture—nearly 17,000 shipments valued at nearly 4 billion—reflects a sustained escalation in enforcement. Electronics, apparel, and automotive goods remain the top targets, signaling regulators’ growing focus on high-risk, multi-tiered supply chains.

Image 1. Total Shipment Metrics for All UFLPA Enforcement Actions Between June 2022 and Sept 2025

Source: CBP

UFLPA detentions have surged more than 350% since 2022, evidence of CBP’s intensifying focus on forced labor risks across global supply chains.

Chart 1. UFLPA Detentions by Year (2022–2025)

Source: CBP

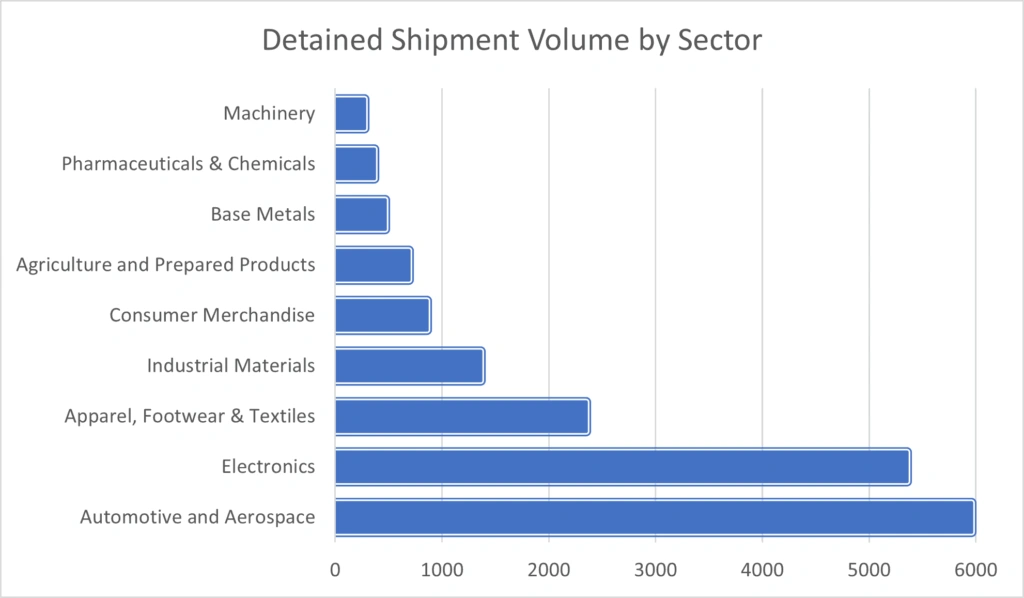

Automotive Overtakes Electronics: A Shift in Forced Labor Enforcement Priorities

In a striking reversal of prior trends, automotive and aerospace imports now account for the largest share of UFLPA detentions in 2025, with 5,961 shipments held by CBP. This marks a dramatic surge from just 248 detentions between mid-2022 and the end of 2024. A growing share of detentions involve parts with components like aluminum and wiring harnesses that rely on raw materials or labor with potential ties to Xinjiang.

Electronics follow closely with 5,355 detained shipments, reflecting ongoing scrutiny of polysilicon, semiconductors, and lithium-ion battery components. The apparel, footwear, and textiles sector remains a major contributor with 2,349 detentions, while industrial materials, consumer products, and agriculture also feature prominently in CBP’s enforcement data.

This shift signals a new enforcement reality: industries once considered low risk are now squarely in the spotlight. Complex, multi-tier supply chains are facing deeper inspection and higher documentation demands under UFLPA review.

Chart 2. UFLPA Enforcements by Sector, June 2022 to September 2025

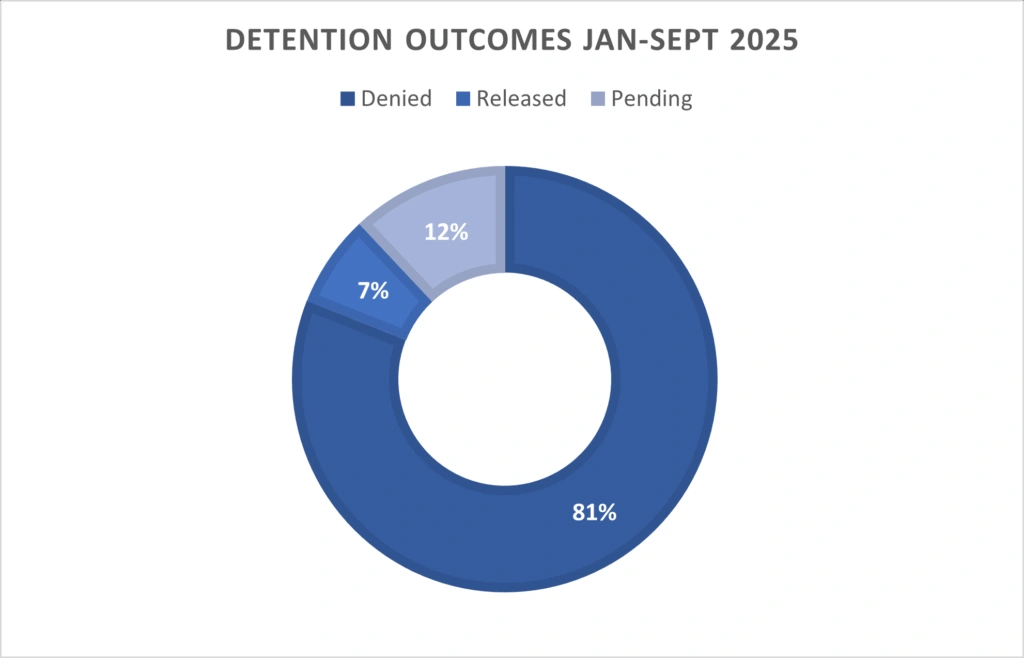

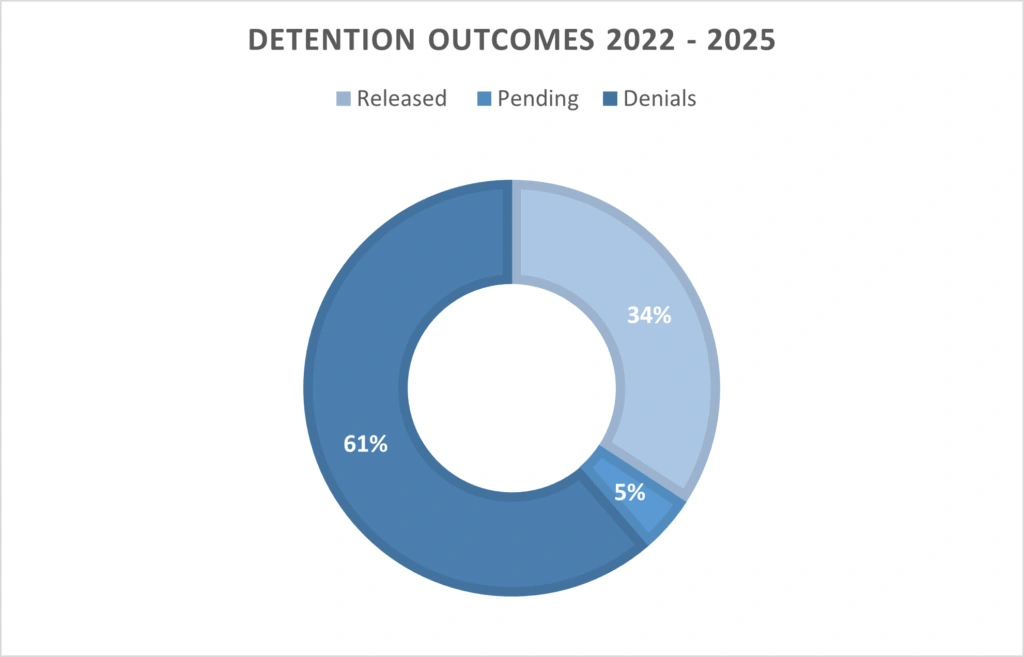

Shipments Released vs. Denied: A Shrinking Margin of Safety

Not every detained shipment is denied—but the margin for release is shrinking. According to the UFLPA Enforcement Dashboard, a growing percentage of detentions are resulting in outright denials, reflecting a stricter evidentiary threshold. UFLPA denials surged in 2025 to 5,745 shipments (83% of all detentions)—nearly triple the 2024 figure and more than six times the denials recorded in 2022.

Once detained, importers must produce detailed supply chain documentation—proof of origin, production records, and traceability reports—within a limited timeframe. In 2025, only 7% of shipments detained under the UFLPA were ultimately released, indicating a high bar for rebuttal. Inadequate documentation often leads to permanent seizure or re-export.

Chart 3. 2025 UFLPA Compliance Outcomes: How Many Detained Shipments Made It Through?

As enforcement accelerates, the cost of uncertainty is rising. For companies importing from high-risk regions, maintaining defensible, data-backed traceability through supply chain compliance software is no longer optional, it’s the only sustainable path forward.

Source: CBP

From China to Vietnam: The Widening Geography of UFLPA Enforcement

While many detained shipments list China as the country of origin, CBP data shows detentions extending to goods from Malaysia, Vietnam, Thailand, and India—countries whose manufacturers often source raw materials or components from Xinjiang-linked suppliers. This highlights one of the most pressing challenges in forced labor compliance: tiered supply chains obscure the true source of materials.

Companies that rely solely on Tier 1 supplier declarations risk missing upstream exposure. In 2025, enforcement is shifting focus toward Tier 2 and Tier 3 suppliers, demanding deeper visibility and verifiable documentation.

Table 1. UFLPA Detention Impact by Country of Origin

| Country | Shipment Value (USD) |

|---|---|

| Malaysia | $1.55B |

| Vietnam | $1.02B |

| Thailand | $0.53B |

| China | $0.44B |

| All Other | $0.11B |

| India | $68.53M |

UFLPA Strategy 2025: Expanding Risk for Forced-Labor Compliance

In August 2025, the U.S. delivered its updated Strategy to Prevent the Importation of Goods Mined, Produced, or Manufactured with Forced Labor in China to Congress — and the results signal a more aggressive compliance era ahead.

Several changes stand out:

UFLPA Entity List Growth Accelerates

The UFLPA Entity List soared from ~66 entities (2024) to 144 entities in 2025, adding 78 new listings in just one year. The business impact includes broader supplier exposure, faster changes, and higher expectations of documentation.

Five New High-Priority Sectors

Five additional sectors now flagged for heightened enforcement:

- Caustic soda (lye)

- Copper

- Jujubes (red dates)

- Lithium

- Steel

Companies outside “traditional polysilicon + cotton risk zones” are newly in scope.

More Robust Enforcement Architecture

The Forced Labor Enforcement Task Force (FLETF) streamlined its entity-listing process and boosted collaboration across government, industry, and international partners. This will make the enforcement deliberations faster and broader, increasing the speed and scope of designations and shipment holds.

Global Momentum: Forced Labor Due Diligence Laws Beyond the U.S.

What began with the UFLPA in the United States is now part of a worldwide trade compliance wave. Across regions, governments are moving from voluntary guidelines to enforceable due diligence laws, creating a new global standard for supply chain accountability.

In the European Union, the Corporate Sustainability Due Diligence Directive (CSDDD) will soon require large companies—and their global suppliers—to identify, prevent, and mitigate human rights and environmental harms across their value chains. Similar frameworks are already in effect:

- Germany’s Supply Chain Due Diligence Act (LkSG): mandates risk assessments and annual reporting, with fines reaching up to 2% of global turnover.

- Canada’s Fighting Against Forced Labor and Child Labor in Supply Chains Act (S-211), which came into force in 2024, obligates companies to publish public reports on their efforts to combat forced labor.

- United Kingdom – Modern Slavery Act: requires companies to publish annual transparency statements detailing anti-slavery actions. Reforms being considered in 2025 aim to introduce penalties for noncompliance.

Taken together, these laws represent a global shift toward mandatory, rather than voluntary, supply chain ethics. For compliance leaders, this marks a powerful turning point: supply chain due diligence has officially moved from policy aspiration to business imperative.

Where Companies Are Most Exposed to UFLPA Violations

Even as awareness of the UFLPA grows, many organizations are still underestimating where their biggest risks lie. Forced labor exposure isn’t limited to direct suppliers—it often sits buried deep in multi-tiered, globally distributed networks.

1. Indirect and Tiered Supplier Risks

Most enforcement cases trace back to Tier 2 and Tier 3 suppliers—the subcontractors and raw material providers that remain invisible to traditional due diligence programs. These upstream risks are often hidden through complex sourcing paths, intermediaries, or incomplete supplier disclosures.

CBP’s focus in 2025 reflects this shift: enforcement officers are tracing inputs like aluminum, lithium, and cotton across multiple countries to uncover connections to Xinjiang. Without full traceability, even goods assembled far from China can still trigger detention.

2. Documentation and Traceability Gaps

The most common reason shipments are denied under UFLPA is insufficient documentation. Importers must be able to demonstrate, often within days of detention, that every material input can be traced to a verified, compliant source.

With U.S. regulators set to invest in supply chain tracing technology and standardized data collection to support enforcement activities, proof requirements will become more digital, granular, and real-time. Companies relying on manual tracking systems including email chains, and static supplier declarations, will be facing longer clearance delays and a higher likelihood of denial.

3. Sector-Specific Enforcement Trends

Some industries are experiencing heightened enforcement.

- Automotive: The recent Withhold Release Order against Giant Manufacturing Co. Ltd., in Taiwan, underscores how forced labor concerns now extend beyond traditional risk zones. Automotive parts, batteries, and components using raw materials tied to Xinjiang are under increased scrutiny.

- Electronics: Semiconductors and solar components remain a major focus due to polysilicon and rare earth material sourcing.

- Apparel and Textiles: Cotton traceability remains a high-risk category, with greater demand for proof of origin and supplier certification.

Caustic soda’s addition to the UFLPA high-priority list introduces a hidden layer of vulnerability across electronics, apparel, and other high-exposure sectors. As a widely used chemical input — from plastic casings in phones and laptops to whitening agents in cotton — it rarely appears in finished-goods documentation. This lack of traceability makes it harder for importers to demonstrate clean sourcing and significantly increases the risk of UFLPA detention or denial.

4. The Compliance Gap: From Policy to Proof

Many organizations have strong ethical sourcing policies but lack the systems to prove compliance. CBP enforcement is increasingly data-driven, requiring evidence that can withstand forensic-level review.

Leading companies are closing this gap with supply chain compliance software that unifies supplier screening, traceability, and audit documentation into one platform. These systems enable proactive risk identification—long before a shipment reaches the port.

How Supply Chain Compliance Software Prevents UFLPA Enforcement Risk

As enforcement intensifies and new global due diligence laws come online, companies need supply chain compliance software to turn fragmented supplier data into actionable intelligence.

- Continuous Supplier Screening and Monitoring: Instead of one-time due diligence, supply chain compliance software enables continuous screening against restricted entities, including those on the expanding UFLPA Entity List and related watchlists. Automated monitoring helps identify changes in supplier status, ownership, or sourcing patterns—reducing the window of exposure before a shipment is detained.

- Supply Chain Mapping and Traceability: Advanced platforms combine supplier declarations, trade data, and third-party intelligence to map the supply chain and spot forced labor risks down to Tier 3 and beyond. Best practice is to consolidate supplier data to identify hidden links with risk management solutions like ownership data, adverse media checks, and screening politically exposed persons.

- Automated Documentation and Audit Readiness: CBP’s review process can turn on a single missing record. Automated documentation tools ensure that importers can retrieve, organize, and present proof of compliance instantly, rather than scrambling after detention. This not only accelerates response time but builds institutional resilience. Capabilities like Descartes’ comprehensive screening and audit history allows compliance teams to demonstrate due diligence across all suppliers and transactions.

- AI-Driven Risk Scoring and Prioritization: Modern compliance software integrates artificial intelligence (AI)-based risk analytics to identify high-risk suppliers, materials, or trade routes. These insights help teams focus investigations and resource allocation, while also reducing false positives that can slow reviews. This aligns with how global regulators—including CBP and the EU Commission—are evolving their own enforcement strategies toward data-driven risk assessment. Leading automotive, electronics, and apparel importers already use Descartes’ AI-powered trade compliance solutions to stay ahead of forced labor enforcement.

- From Reactive to Resilient Compliance: The ultimate value of supply chain compliance software lies in shifting compliance from a reactive task to a resilience strategy. By integrating ownership insights, entity screening, and supplier traceability in one system, companies can anticipate risk, prove compliance with confidence, and sustain global operations despite tightening regulations.

Build Resilient, Ethical, and UFLPA-Compliant Supply Chains with Descartes

As enforcement of forced labor laws intensifies, especially under the UFLPA, the burden of proof lies with businesses. Every detained shipment represents not just financial loss, but brand damage and operational disruption that can ripple across supply chains.

Descartes supply chain compliance software isn’t just about screening—it’s about building resilience. The solution can help you:

- Re-classify your suppliers by exposure to newly identified sectors

- Integrate real-time denied party screening and ownership mapping to spot connections to entities listed under UFLPA and subject to global due diligence laws

- Secure fast-track clearance by providing traceability on demand

- Maintain a clean audit trail for CBP and other regulatory inquiries

- Train your operations, sourcing, and compliance teams together — the rules now connect sourcing decisions with shipment holds and fines.

This proactive approach gives compliance teams real-time alerts, allowing them to act before shipments reach the port—protecting both revenue and reputation.

Ready to see how Descartes can help safeguard your supply chain? Request a demo today.

Find out what our customers are saying about Descartes Denied Party Screening on G2 – an online third-party business software review platform. Additionally, you can read this essential buyer’s guide to denied party screening to help you select a solution that fits your needs.