What if the fastest deal your sales team closes this quarter ends up being your company’s most expensive mistake?

In today’s high-pressure sales environment, one unchecked name in your customer relationship management (CRM) platform could cost millions. To prevent this, denied party screening also called sanctions screening is a must. Sanctions screening is the process of checking customers, vendors, and partners against government sanctions and watchlists. However, when it’s handled manually or treated as an afterthought, it slows deals, frustrates buyers and sales teams, and still leaves companies exposed to sanctions risk.

And the stakes couldn’t be higher. Recently, a major software company was fined $3.3 million for more than 1,300 apparent violations of U.S. sanctions and export controls, partly due to gaps in screening users across its CRM and cloud platforms. Enforcement agencies like the Office of Foreign Assets Control (OFAC) and Bureau of Industry and Security (BIS) continue to spotlight the sales process as a hotbed for compliance failures, from vague product descriptions to rushed deals and hidden end uses. These aren’t just regulatory slip-ups—they’re revenue killers.

Forward-looking organizations are rethinking sanctions screening altogether. Instead of bolting compliance onto the end of a sales process, they’re embedding sanctioned / denied party screening directly into everyday business tools, like CRM and Enterprise Resource Planning (ERP) systems. Done right, this transforms screening from a sales roadblock into a real-time safeguard—one that accelerates sales velocity, reduces risk, and gives teams the confidence to close deals with speed and certainty.

Video 1: Descartes Jackson Wood Explains How Integrated Sanctions Screening Software Supports Business Growth

That’s where this guide comes in. We’ll show you how companies like yours can integrate sanctions screening software to streamline compliance without slowing sales down, how to stay ahead of regulations, and build customer trust with a frictionless due diligence process.

Key Takeaways

- Integrated sanctions screening eliminates manual bottlenecks in the sales cycle by screening third parties directly within CRM and ERP systems.

- Early identification of sanctioned, restricted, or denied parties prevents wasted time, lost deals, and compliance violations.

- Integrated tools enhance accuracy through automated updates from global watchlists and sanctions data.

- Sales, compliance, and IT alignment are essential to embed screening into everyday workflows without disrupting performance.

- Sales enablement now demands trade compliance tools that move as fast as the teams they support. Integrated sanctions screening software from Descartes enables real-time screening, audit trails, and customizable risk thresholds across all major business systems.

The Sales-Compliance Challenge: Balancing Growth and Risk

At most organizations, sales and compliance are chasing two different goals. Sales teams are under pressure to move deals forward quickly. Trade compliance teams are tasked with ensuring every transaction passes regulatory scrutiny. This creates an increasingly difficult balancing act: driving growth while keeping pace with mounting compliance obligations. Nowhere is this tension more evident than in sanctions screening.

Sales teams are often the first to introduce new customers, partners, or transactions into the business. Every new entry carries potential compliance risk, especially when operating across new regions or industries. Without integrated sanction screening at this stage, critical red flags can slip through and remain undetected until violations occur.

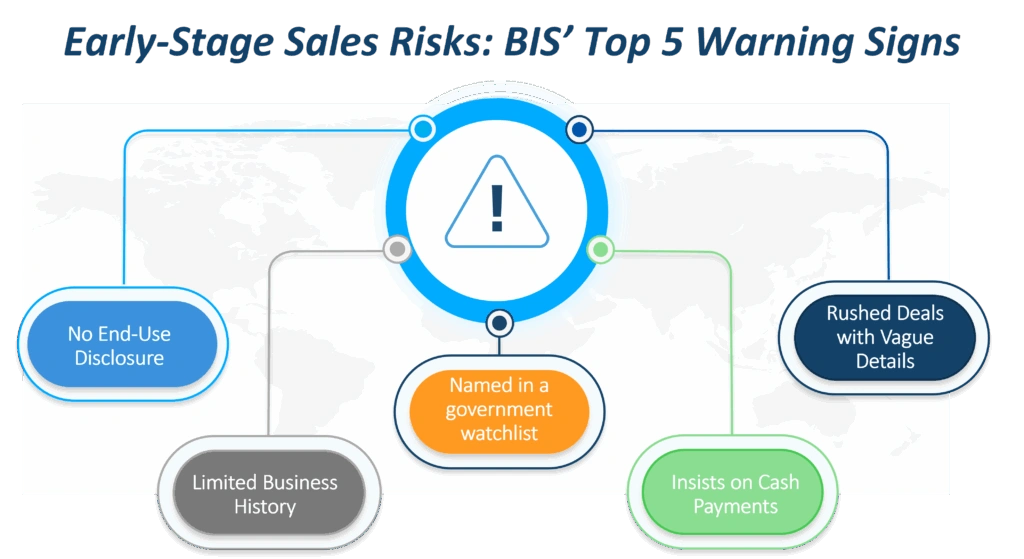

The BIS highlights several “Know Your Customer” warning signs that can emerge early in sales interactions, including:

- Customers unwilling to disclose the end use of a product

- Minimal or no business background

- Attempts to pay in cash when financing is available

- Rushed transactions with little product understanding

- Being listed explicitly on a government watchlist

Image 1: Top 5 Export Compliance Red Flags in Sales: BIS Guidance for Risk Detection

These risks aren’t always obvious at first contact, making real-time, automated alerts essential for identifying high-risk transactions. Regulators like OFAC, BIS, and the DOJ are increasingly holding organizations accountable—including sales functions—when failures occur. To balance growth with compliance, businesses must equip sales teams with tools that streamline screening without slowing down performance.

The Trade Compliance Bottleneck: Why Sales Teams Struggle with Manual Sanctions Screening

Even organizations committed to sanctions compliance often underestimate the complexity of denied party screening. Sanctions lists are updated daily across dozens of jurisdictions, new names are added without warning, and the penalties for violations can devastate revenue. As Descartes Senior Implementation Manager Richard Smokorowski explains:

No matter how large or small your business is, automation eliminates gaps in your compliance process. If screening is directly integrated into your CRM and sales systems, you close off exposure and ensure due diligence.”

When sales teams rely on manual or disconnected processes to screen for sanctioned or denied parties, deals grind to a halt. Each new lead, quote, or transaction requires time-consuming checks across multiple lists and systems, distracting sales from their core focus—building relationships and closing business.

The burden doesn’t stop there. Inconsistent screening procedures increase the risk of overlooking a restricted party altogether, exposing the organization to costly fines and enforcement actions. Even when errors are avoided, manual reviews can slow down response times and derail sales momentum.

The impact isn’t just internal. Customers experience delays, repeated requests for information, or even false alerts that put legitimate business at risk. These friction points damage trust and create an impression that your organization is difficult to work with—especially when competitors can move faster. Put simply, the effects of inefficient sanctions screening processes on sales are hard to ignore:

- Slower sales pipelines: Manual reviews add days to deal cycles, delaying revenue.

- Missed quota: Inconsistent checks risk blocked or canceled deals after the fact.

- Lost prospects: Delays frustrate customers and can push them to competitors.

- Damaged trust: False positives or repeated data requests make onboarding painful.

Manual compliance doesn’t just drain time; it damages revenue potential, frustrates customers, and undercuts sales performance.

The Smarter Approach: Integrated Sanctions Screening Software that Powers Compliance at the Speed of Sales

To break the bottleneck, the solution isn’t to choose between speed and compliance. It’s to integrate denied party screening directly into the systems sales teams already use—like Salesforce, NetSuite, SAP, or Microsoft Dynamics. This means screening happens automatically at key points in the sales process, like lead qualification, onboarding, or deal closure.

With Descartes, for example, sanctions screening can be triggered in real time within your CRM, giving reps immediate feedback on whether an entity is clear to move forward in the sales pipeline, without requiring reps to leave their workflow. Compliance teams still maintain oversight and control, but much of the manual burden is eliminated.

Key advantages and features of robust integrated sanctions screening software:

Automated Sanction List Updates

Systems connect to authoritative sources for restricted party content, so screening is always current. Many solutions like Descartes also offer specialized third-party data sources to account for narrative guidance like the OFAC 50 Percent Rule and the proposed BIS 50% Rule, ensuring that indirect ownership by sanctioned parties is flagged even if the entity itself isn’t named directly.

Embedded Sales and Compliance Workflows

Screening is part of lead qualification, order processing, and partner onboarding. Features that streamline collaboration, provide centralized supervisor review and trigger automated escalations help sales teams move faster while ensuring compliance teams maintain oversight.

Transparent Compliance Trail

Every decision and due diligence activity is logged, supporting audits and regulator inquiries. This is especially critical for OFAC year-end reporting, where regulators often require detailed OFAC screening history.

AI-Powered Sanctions Screening Accuracy

Artificial intelligence (AI) improves match quality and accuracy by learning from past results, reducing false positives, and flagging risks that might have been missed.

Flexible Risk-Based Screening Controls

Sanctions screening thresholds can be tuned to match a company’s risk profile, industry, location, or nature of business. This customization ensures that compliance efforts are both effective and proportionate, minimizing unnecessary alerts while maintaining regulatory integrity.

Dynamic Rescreening against Restricted Party Lists

Easily schedule regular checks to match the frequent updates to global watchlists. This helps maintain your organizations compliance posture and reduce exposure to newly sanctioned entities. A customer cleared for business today could appear on a denied party list tomorrow.

This automated approach creates a seamless partnership between sales and trade compliance, removing friction without sacrificing diligence.

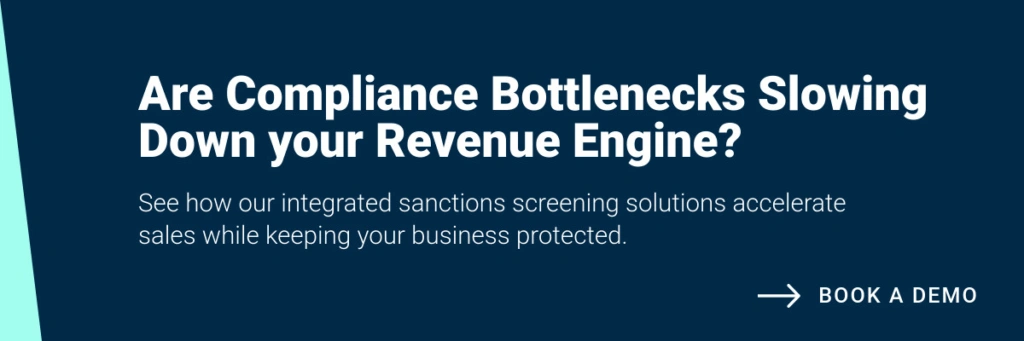

Image 2: Business Systems that Integrate with Sanctions Screening Software: CRM, ERP, HR, Finance Platforms and more.

Key Business Benefits: Secure Growth, Stronger Compliance

Integrating sanctions screening software shifts compliance from a gatekeeper to a sales accelerator. Instead of wasting time, missing red flags, or risking costly penalties, by aligning screening with how sales teams actually work, they can focus on growing the sales pipeline and closing revenue-driving deals.

Here’s how integrated sanctions screening software delivers measurable impact:

- Faster Sales Cycles: Automated checks flag restricted parties early, so your team doesn’t waste hours—or even weeks—on deals that will never clear compliance. Faster answers mean faster revenue.

- Higher Compliance Confidence: Integrated tools ensure you’re always screening the most comprehensive customer / business information against the most current restricted party list data, improving compliance rates and strengthening defensibility with regulators.

- Improved Trust and Alignment: Sales and compliance teams work from the same playbook, reducing resistance and building confidence across the organization. Customers also benefit from smoother onboarding and fewer unnecessary delays.

- Enhanced CRM Return on Investment (ROI): Unlock more value from your tech stack by extending its capabilities. With integrated denied party screening, every interaction in CRM platforms like Salesforce, will be automatically checked without disrupting existing workflows. That means less duplication of effort and a higher return on the tools you already use.

- Scalable Risk Management: Cover everything from prospecting to ongoing customer engagement with one solution. As transaction volumes grow, screening capabilities expand with you without adding to headcount.

The results speak for themselves: organizations like EDB, Movella, and Argosy that rely on automated and integrated screening have cut wasted time, improving productivity by up to 75% and avoided the costly distractions of failed deals and regulatory fines.

5 Best Practices for Implementing Integrated Sanctions Screening Software

So, how do you actually make integrated sanctions screening software work in your sales tools? It comes down to careful implementation—aligning systems, processes, and people from the start.

- Plan for Business Outcomes: Don’t just “add screening.” Define what success looks like. Is it faster client onboarding, fewer manual reviews, or reduced sanctions compliance exposure? Align screening goals with business growth targets so both sales and compliance win.

- Understand your Due Diligence Scope: Sanctions screening isn’t a single step. Understand how third parties are introduced throughout your sales process, from lead qualification and quoting to onboarding and renewals. This ensures every stage is covered and no risky party slips through.

- Engage Cross-Functional Teams: Integration only succeeds if sales, compliance, and IT work together. Involve sales early so the solution fits naturally into their CRM workflows, reducing complexity instead of adding another system to manage. And as Smokorowski warns, integration must be a shared responsibility:

Integration can’t be left to IT alone. When the technical team builds without input from compliance and sales/operations, it’s a recipe for disaster. All sides need to work together to make screening effective.”

- Enable Adoption with Training: Provide regular training, update resources, and build internal champions so your teams understand how to use integrated screening effectively and confidently. This knowledge is critical, as adoption and accuracy improve significantly when teams understand how sanction screening works and why it matters.

- Choose the Right Trade Compliance Partner: Not all vendors are built for intricate integrations. Look for vendors with proven expertise in integrating sanctions screening into CRM, ERP, and trade systems. Strong vendor support minimizes deployment disruption and ensures long-term reliability.

By focusing on outcomes, workflows, collaboration, expert partnerships, and adoption, organizations can implement integrated screening that accelerates sales and strengthens compliance.

For a deeper dive, see our guide on integrated denied party screening best practices.

Descartes Sanctions Screening Software Helps Protect Revenue, Brand Reputation, and Customer Trust

Descartes offers a comprehensive suite of denied party screening and third-party risk management tools that integrate directly with the systems your team uses every day. From Salesforce sanctions screening to sanctions screening in ORACLE, our plug-and-play integrations streamline compliance, minimize disruption, and let your sales team keep selling with confidence.

Our solutions provide real-time regulatory updates, seamless integration with business systems, and audit ready reports to demonstrate your due diligence efforts. We also offer enhanced forced labor risk mitigation capabilities to prevent trade violations. Additionally, our AI-powered solutions reduce false positives in sanctions screening by up to 60%.

In as little as a day, you can turn trade compliance from a bottleneck into a business accelerator. Request a demo to see how integrated sanctioned party screening keeps your sales pipeline moving—safely.

Find out what our customers are saying about Descartes sanctions screening software on G2 – an online third-party business software review platform. Additionally, you can read this essential buyer’s guide to denied party screening to help you select a solution that fits your needs.