Effective January 15, 2026, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) released a significant final rule revising export licensing requirements for advanced semiconductor chips destined for China. The update shifts review for the Nvidia H200, AMD MI325X, and similar high-performance chips from a presumption of denial to a case-by-case evaluation of export license applications, provided exporters meet a set of newly established security and compliance conditions.

This policy shift follows President Trump’s December 8, 2025 announcement that the U.S. would permit shipments of advanced computing products to approved customers in China under controlled circumstances to support national security objectives. For U.S. exporters, this is not a simple policy relaxation—it is a structural change in semiconductor export controls, which are becoming more dynamic and documentation-heavy.

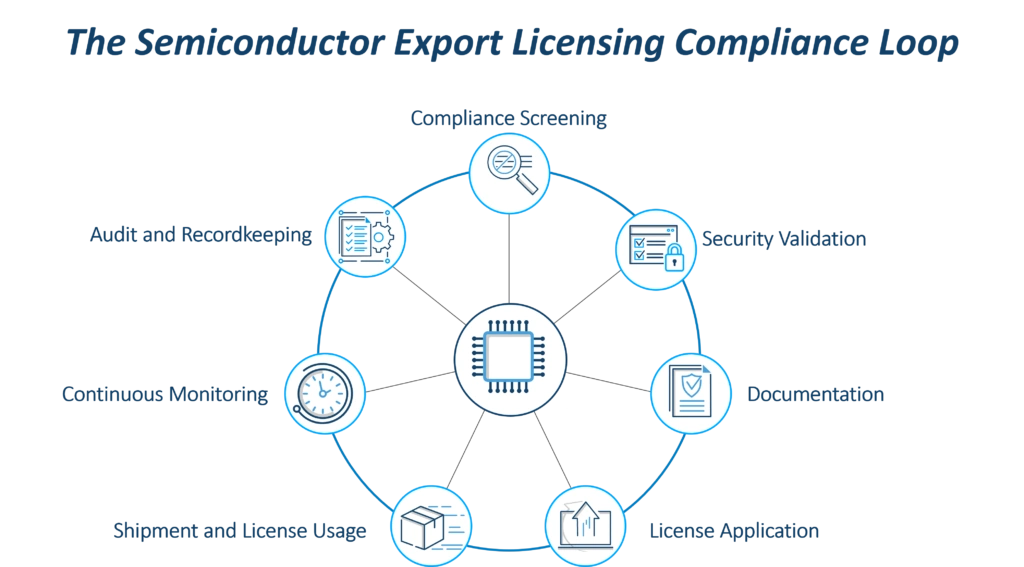

With export licensing evolving beyond a simple binary “approved or denied” decision into an evidence-driven, continuously monitored process, trade compliance programs must support dynamic export licensing workflows, structured evidence management, and audit-ready documentation to maintain compliance. This article unpacks what the rule requires and how trade compliance technology can help companies meet BIS expectations efficiently and confidently.

Key Takeaways

- BIS has replaced blanket denial with controlled access: Some semiconductor exports to China are now licensable on a case-by-case basis.

- Export licensing is now evidence-driven and operationally heavy: Approval depends on documented capacity impacts, end-use controls, third-party testing, and audit-ready records.

- Compliance obligations extend beyond the export license decision: Exporters must monitor shipments, enforce license conditions, prevent unauthorized remote access, and retain records for years.

- This shift signals how semiconductor export controls are becoming transaction-specific risk assessments that require stronger due diligence, tighter recordkeeping, and more consistent internal controls.

- Export licensing and compliance technology enable speed and defensibility: Descartes Export Licensing software turns compliance requirements into repeatable, auditable workflows—transforming regulatory burden into competitive advantage.

What Changed: BIS’s New Case-by-Case Export Licensing Policy

BIS will now evaluate export license applications for advanced artificial intelligence (AI) chips such as the H200 and MI325X individually rather than under a blanket restriction model. This allows the shipments of semiconductor chips typically classified under Export Control Classification Number (ECCN) 3A090 to be sent to China and Macau.

Before the January 2026 final rule took effect, exports of advanced computing chips were subject to a presumption of denial, meaning BIS generally did not authorize their export to China or other sensitive destinations.

Under the new rule, this presumption of denial continues to apply in several areas:

- Reexports, exports from abroad, and in‑country transfers of advanced AI‑related commodities that are subject to the EAR and destined for Macau or any Country Group D:5 destination remain subject to a presumption of denial.

- The same presumption applies to transactions involving entities headquartered in, or owned by a parent company headquartered in, Macau or a Country Group D:5 location, even when the end‑user is physically located outside those jurisdictions.

These restrictions reinforce BIS’s focus on limiting access to sensitive advanced‑computing technologies by high‑risk end users, even as the new rule introduces more flexible case‑by‑case review pathways for certain direct exports from the United States. According to BIS, approvals will depend on whether exporters can demonstrate:

- The export will not reduce global semiconductor production capacity available to U.S. customers.

- The Chinese purchaser maintains export compliance procedures, including customer screening.

- The product has undergone independent, third-party performance and security testing in the United States.

Under Secretary for Industry and Security Jeffrey Kessler emphasized the national security intent behind the change, stating that adjusting export controls as technology evolves will “strengthen the American technology ecosystem.” This rule change is also linked to broader objectives of the U.S. government to promote the export of American AI technology stack.

This means more export license applications, more documentation, and more regulatory scrutiny. In the following section, we explain how this increases operational and compliance complexity.

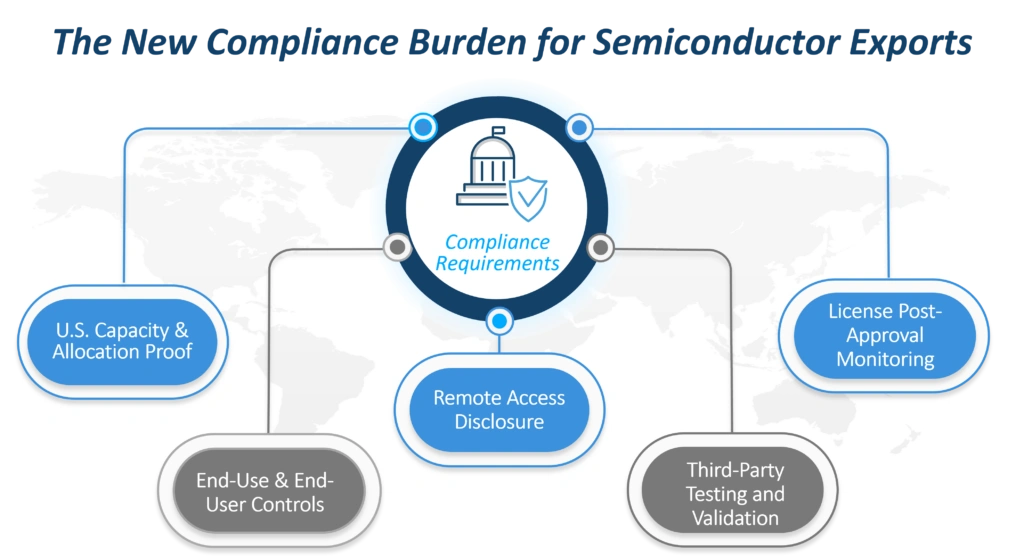

The New Export Compliance Burden: What Businesses Must Now Prove

Under the revised policy for semiconductor export license applications, businesses must prove compliance through structured evidence. Approval now depends not only on what is being exported, but also on whether companies can demonstrate—with documentation, controls, and audit-ready records—that every export licensing condition has been satisfied and will continue to be enforced after shipment.

Image 1. The 5 Things Exporters Must Do to Qualify for Semiconductor / Advanced AI Chips Exports

1. No Impact to U.S. Semiconductor Capacity

The chip must already be sold in the U.S. at the time of the export license application and exporters must demonstrate that shipments will not reduce production capacity currently available to U.S. customers. Specifically, supporting data must show:

- Items operate below the rule’s performance thresholds.

- How many units have been sold within the U.S. market.

- That U.S. foundry capacity for similar or more advanced chips will not be diverted to support production for China.

- Aggregate shipments to China and Macau must not exceed 50% of total units shipped for U.S. end use.

This requires:

- Documented production and allocation planning

- Shipment records tied to license applications

- Evidence of capacity commitments to domestic customers

Without structured records, this requirement becomes nearly impossible to prove consistently.

2. Transaction Doesn’t Include Prohibited End-Use or Restricted Party Involvement

The transaction must not involve any prohibited end use or restricted end user under U.S. export controls. Exporters must certify that the advanced chips will not be used for military, intelligence, or weapons-related activities, including nuclear, missile, chemical, or biological weapons purposes. They must also confirm that no party to the transaction—including the ultimate consignee, end user, or any party granted access to the chips—is subject to U.S. export restrictions.

This will create heightened expectations for:

- Documented denied party screening results for all counterparties and beneficial owners

- Verified end-use statements and certifications from customers and consignees

- Evidence of how screening matches were resolved and escalated

- Audit-ready records demonstrating how end-use and end-user risks were assessed and mitigated

Compliance screening and documentation needs to be consistent to prevent enforcement risk.

3. Verified Chinese Customer Compliance Programs

Under the new semiconductor export licensing rule, BIS expects businesses to show that Chinese purchasers maintain export compliance procedures, including customer screening. They must also describe the physical security measures at the consignee’s facilities to prevent diversion, tampering, or unauthorized access to advanced chips.

This introduces new compliance obligations:

- Third-party due diligence documentation

- Counterparty screening records

- Compliance attestations

- Internal access-control documentation

- Site-level security descriptions

- Facility governance and monitoring procedures

- Ongoing monitoring evidence

These records must be retained, version-controlled, and auditable.

4. Independent Third-Party Testing Documentation

Before the advanced computing chips can be shipped, the product must be tested in the United States to verify performance and security match what the exporter reported.

Exporters must maintain:

- Testing certifications

- Audit reports

- Product traceability between tested and shipped units

This evidence must be directly linked to each export license application.

5. Remote End Users and Infrastructure-as-a-Service (IaaS) Controls

When exported chips may be accessed through cloud or data-center environments, exporters must disclose and manage remote end users, not just the ultimate consignee.

Exporters must:

- Provide BIS with a list of any intended remote end users located in countries of concern (e.g., Russia, North Korea, Venezuela) or entities headquartered or whose ultimate parent company is in those jurisdictions

- Obtain this information from the ultimate consignee or other transaction parties

- Demonstrate that no prohibited users will be granted remote access

If the consignee or end user provides IaaS, exporters must also verify that the provider:

- Will not transfer model weights trained on the chips to unauthorized users

- Will not grant prohibited parties remote access to trained algorithms

- Will comply with all end-user and end-use restrictions

In practice, this means:

- Collecting detailed remote-user listings and contractual commitments

- Documenting end-user agreements and IaaS access controls

- Recording verification steps that confirm compliance with remote access restrictions

- Ongoing compliance monitoring records

This introduces an entirely new category of due diligence, documentation, and post-approval compliance risk.

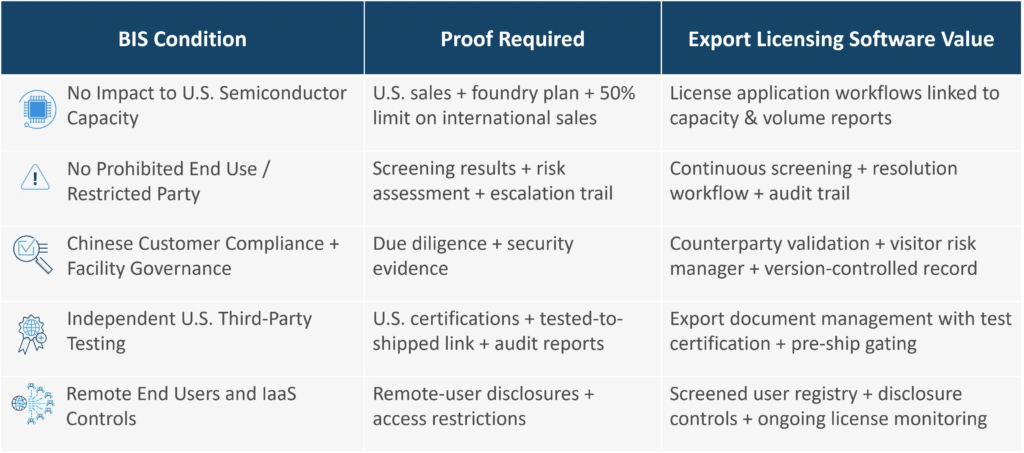

How Export Licensing Software Enables Compliance with the New BIS Policy for Semiconductors

Case-by-case export licensing fundamentally changes operational demands. Manual, spreadsheet‑driven, or otherwise outdated compliance systems cannot scale when exporters must assemble complex license application packages, maintain multi‑year audit‑ready records, track license conditions and usage, and monitor post-approval compliance.

Meeting these requirements consistently requires purpose-built export licensing technology that embeds evidence collection, controls, and documentation directly into day-to-day operations.

Table 1. Mapping BIS Proof Obligations to Export Licensing Software Capabilities

Key Export Licensing Software Capabilities that Help

The following details essential capabilities that help demonstrate continuous compliance, not just one-time eligibility.

Workflow Automation for Case-by-Case Export License Review

Robust export license acquisition solutions can provide guided, policy-driven workflow triggers for:

- License application steps

- Internal approvals

- Compliance sign-offs

Such controls block shipments until all rule-specific conditions, attestations, and supporting evidence are complete, ensuring applications are comprehensive, consistent, and audit ready.

Centralized Export License and Condition Management

Export license management software links licenses directly to products, customers, ECCNs, and shipments. Within the context of the BIS semiconductor licenses, the software centrally ties these to specific chips covered by the policy, end users, approved IaaS conditions, shipment thresholds, and reporting obligations. License scope and conditions are automatically enforced at the order and shipment stage, ensuring exporters do not exceed approved volumes, violate end-use restrictions, or bypass post-approval compliance requirements.

Integrated Denied Party & End-User Screening

Integrated denied party screening evaluates customers, ultimate consignees, affiliates, beneficial owners, and disclosed remote IaaS users against official sanctioned and restricted party lists, including BIS Entity List and Military End-User controls. Screening happens in real-time and is embedded into licensing and order workflows, with results automatically documented in the export license file to demonstrate compliance with end-use, end-user, and remote access restrictions.

Structured Evidence & Document Management

Purpose-built platforms store and version-control:

- Third-party testing reports

- Customer compliance attestations

- Screening and due diligence records

All evidence is retained in a single audit-ready repository.

Post-License Monitoring & Reporting

Export licensing software continuously monitors shipments against approved export license quantities, destinations, and end-use limitations, while tracking license validity and condition-specific obligations. Automated controls prevent over-shipments or unauthorized use, and on-demand audit reports provide BIS-ready evidence of post-license compliance throughout the license lifecycle.

Image 2. Case-by-case export licensing turns trade compliance into a continuous evidence lifecycle.

Strategic Considerations for Semiconductor and AI Hardware Exporters

This export rule change foreshadows how export licensing will likely function for advanced technologies going forward. Controlled access models may become more common, where exports are neither broadly prohibited nor freely allowed, but permitted through evidence-driven, continuously monitored licensing frameworks. For exporters, this raises the bar on compliance maturity while simultaneously reopening market access that had been effectively closed.

Critically, the licensing shift was paired with import tariff measures and U.S.-based testing requirements, reinforcing a U.S.-centered supply chain model. Together, these policies reshape trade routes, increase documentation obligations, and elevate the role of domestic validation, testing, and compliance infrastructure. Exporters must now align export licensing, tariff planning, and supply chain documentation into a single, defensible compliance narrative.

Commercially, the rule creates a controlled, licensable export pathway rather than an outright ban—allowing U.S. companies to capture high-value demand for AI-grade chips in China while maintaining national-security guardrails. Companies that can operationalize compliance—by proving end use, managing license conditions, and sustaining post-approval controls—will move faster, reach approved customers first, and gain a durable competitive advantage in a constrained global market.

Best Practices for Operating in the New Semiconductor Export Licensing Environment

Success under BIS’s revised semiconductor licensing framework will depend on balancing policy interpretation with operational execution. Leading organizations are focusing on the following best practices:

- Treat Export Licensing as a Lifecycle Process, Not an Event: Reassess current export licensing workflows and treat licenses for semiconductors as living assets.

- Run Early Third-Party Testing Trials: Conduct early pilot tests to validate lab readiness, understand throughput constraints, and establish realistic lead times.

- Align Production, Allocation, and Licensing Planning: Capacity commitments, shipment thresholds, and China volume caps must be aligned across supply chain, sales, and compliance.

- Operationalize End-Use and Remote Access Controls: Restricted party screening, end-use validation, and remote access restrictions must be embedded into operations. Evidence must demonstrate prevention efforts.

- Consolidate Proof and Documentation from Day One: Every data point submitted must be retained, linked to the license, and retrievable for years.

- Design for Audit and Regulatory Engagement: Case-by-case licensing invites deeper BIS engagement. Assume follow-up questions and ongoing oversight—and build processes that can respond quickly with complete, defensible records.

- Update Internal Export Control Processes: Repeatable, auditable export compliance processes are a prerequisite not just for avoiding enforcement risk, but for maintaining speed to market when export licensing windows open.

Optimize Compliance Screening and Export Licensing for Semiconductor Exports with Descartes

Winning licensed semiconductor and advanced AI chip sales now requires airtight evidence: domestic‑supply certifications, performance disclosures, denied party screening, third‑party U.S. testing records, and auditable controls for end‑use and end‑user risk. Manual workflows or inadequate compliance solutions slow you down and put export license approvals at risk.

Descartes’ export licensing and trade compliance solutions are purpose-built for this new enforcement and opportunity landscape. By unifying license management, denied party and end-user screening, evidence tracking, workflow automation, and audit-ready recordkeeping in a single platform, Descartes helps exporters operationalize compliance at scale without slowing business momentum.

See how Descartes can help you modernize export licensing and confidently navigate evolving BIS requirements. Request a demo today.

Find out what our customers are saying about Descartes Denied Party Screening on G2—an online third-party business software review platform.